Apr 19, 2024

Wall Street Fires Up Deals for Preferred Shares With Fed on Hold

, Bloomberg News

(Bloomberg) -- Fading hopes that the Federal Reserve will soon cut rates are prompting US banks to re-evaluate the cost of their preferred stocks, potentially sparking a rush of deals for the crucial source of capital.

In the past week, Goldman Sachs Group Inc. sold $2.25 billion of new preferred shares — hybrid instruments used by banks to bolster their balance sheets — to replace an existing series while Citigroup Inc. announced the repayment of $1.25 billion in older issues. Similarly, JPMorgan Chase & Co. is set to redeem four series of its preferred stock by May following a new issue.

These moves are firing up the US market for bank capital after months of muted activity. Where expectations of swift policy easing previously convinced lenders that the cost of preferred shares with floating-rates would come down, creating a better opportunity to replace them later, the narrative of higher-for-longer is now prompting them to take action.

“What we see lately is capitulation. In this higher-for-longer environment, some banks got tired of paying these high coupons,” said Douglas Baker, head of preferred securities at Nuveen Services LLC. “Inflation could just as easily grind higher and issuers don’t want to look at the rear-view mirror and say we ‘shoulda, coulda.’”

US banks currently have more than $25 billion’s worth of preferred shares with floating dividends that are costing them at least 100 basis points more than the fixed rates that have been locked in through new deals so far this year.

Used to raise Additional Tier 1 capital, preferred stocks are usually issued with a set coupon for at least five years when they are not callable before transitioning to a variable dividend, when the issuer can also choose to repay them, typically on a quarterly basis.

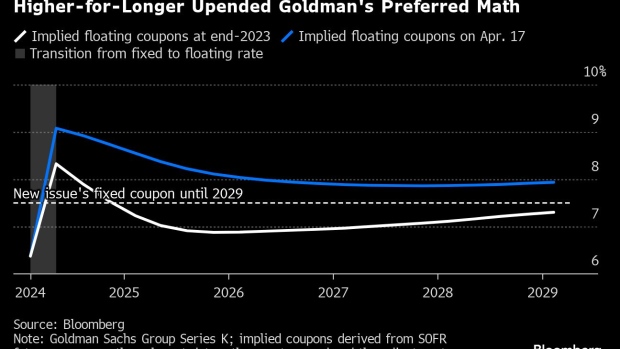

Timing the repayment partly comes down to the modeling of an expected path of interest rates once a preferred enters its floating period and comparing it to the cost of a new series at a fixed coupon. The underlying rate — typically the Secured Overnight Financing Rate, or SOFR — is influenced by Fed policy, which is why shifting expectations of cuts are making such a difference.

This means that at the end of last year, when traders were pricing in more than six cuts by the Fed for 2024, it would’ve been cheaper over the long term for Goldman Sachs to keep its preferred stock issue outstanding, rather than replacing it immediately. Now that traders anticipate fewer than two cuts, the math has changed.

“Banks have left preferreds outstanding with 8% or 9% coupons as a drop in interest rates would bring these coupons down,” said Robert Smalley, a financials credit desk analyst at UBS Securities LLC. “Now it’s clear that rates are not coming down quickly and demand for new issues is robust so they’re moving to refinance them.”

A representative at JPMorgan Chase declined to comment. Bloomberg News has reached out to Goldman Sachs and Citigroup for comment.

Basel Endgame

The changing rates backdrop is adding fuel to a market that initially seemed set for a quiet year.

Banks were not only expecting rates to come down faster but also waited to see the extent of pending changes in banking regulations — known as the Basel Endgame — and their impact on capital requirements. Fed chair Jerome Powell’s congressional testimony in March that more onerous proposals would be scaled back has since alleviated some concerns.

While preferred shares in the US have been in relatively short supply this year, the issuance of AT1 bonds — Europe’s equivalent with a more established tradition of being called at the first opportunity — has boomed, with sales in the first three months at the highest since 2019, according to data compiled by Bloomberg.

To be sure, the expected path of rates is only one of many indicators that banks look at when deciding to redeem a preferred series. The spread over the underlying rate as well as lenders’ capital adequacy also play a role, meaning that no two call decisions can be exactly the same.

Still, the ground is set for faster supply of preferred shares, albeit to replace existing issues, keeping the market’s size broadly stable. A further drop in the risk premium that banks have to pay over the underlying rate could even bring back smaller lenders that have been sidelined since the regional banking crisis of early 2023.

“The combination of the changed rates curve and a better capital planning environment for the banks is driving issuance for now, said Spencer Phua, senior desk analyst at Piper Sandler Credit Trading. “If spreads continue to rally, we should see some mid-sized regionals issue as well.”

©2024 Bloomberg L.P.