Sep 25, 2022

Australia Central Bank’s Digital Currency Pilot Likely Next Year

, Bloomberg News

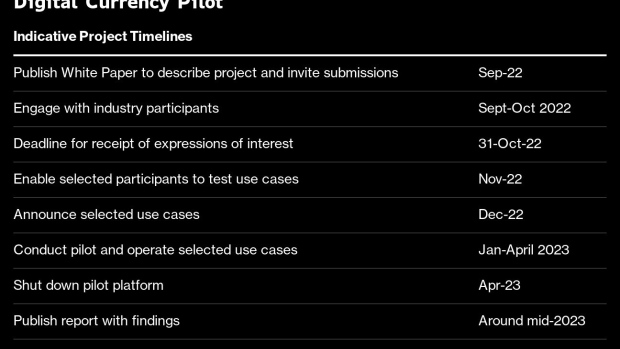

(Bloomberg) -- The Reserve Bank of Australia is working to identify business models and uses for a central bank digital currency, or eAUD, and is likely to conduct a pilot early next year.

The project, which began in July, will help “further understanding of some of the technological, legal and regulatory considerations associated with a CBDC,” the RBA and the Digital Finance Cooperative Research Centre said in a White Paper Monday.

The findings will be published at the conclusion of the project in around mid-2023. The research implies no commitment from the RBA to issue a CBDC, it added.

Central banks worldwide are acting swiftly to ensure they don’t fall behind as money edges toward its biggest reinvention in centuries with alternative concepts like cryptocurrencies taking hold. That new technology, as well as events like the coronavirus pandemic, are among forces pushing consumers to go cashless.

The RBA is seeking submissions from industry participants ranging from financial institutions, fintechs, public sector agencies and technology providers. It is also engaging with regulators to work through any regulatory implications.

Participants are expected to submit:

- Use cases that utilize CBDC; and

- Expressions of interest to operate their use case

All proposals will be used to inform assessments of the rationale for an eAUD, the White Paper said. A limited number will also be selected for operation within the CBDC pilot project infrastructure. Pilot participants will bear their own costs for the conception, design, development, implementation and piloting, if selected.

©2022 Bloomberg L.P.