May 31, 2023

Bangladesh Readies Higher Taxes in Budget in Test of IMF Reforms

, Bloomberg News

(Bloomberg) -- Bangladesh proposed raising taxes and boosting spending in its annual budget Thursday in a test of Prime Minister Sheikh Hasina’s prudent policymaking over populism ahead of elections due next year.

Trying to balance the budget is not a choice for Hasina, but a requirement from the International Monetary Fund, which in January approved $4.7 billion to the South Asian nation.

The funds tied to conditions such as widening tax revenue, reforming the financial sector and removing subsidies couldn’t have come at a more delicate time for the 75-year-old leader who faces elections, that analysts and critics say she’s likely to win, though discontentment over rising living costs remains a risk.

“While formulating the budget, we have prioritized poverty alleviation, contemporary economic challenges and future development initiatives,” Finance Minister AHM Mustafa Kamal said in his budget address to parliament. “New sectors of revenue collection will be focused on to ensure an adequate supply of resources.”

Hasina insisted last week that Bangladesh was in a position to pay back the IMF loan, saying the lender only gives assistance to countries that can repay their bill. Not all share that confidence.

Just days before the budget presentation, Moody’s Investors Service cut Bangladesh’s credit rating deeper into junk territory, citing concerns of “heightened external vulnerability and liquidity risks” along with institutional weaknesses.

Here are key highlights from Thursday’s budget:

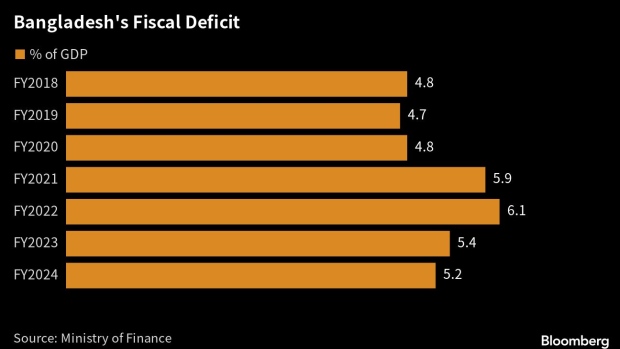

Fiscal Deficit

Bangladesh is targeting a fiscal deficit of 5.2% of gross domestic product for the year starting July 1, slightly wider than the 5.1% gap it sees in the current year based on revised estimates. Moody’s expects the fiscal deficit to remain around 5% to 5.5% over the next few years.

Tax Targets

Under the IMF program, Bangladesh has to raise the revenue-to-GDP ratio by 1.5 percentage points by 2026 to boost spending on social, development and climate projects. Kamal used the budget to make a case for the government to stop giving out tax exemptions, echoing IMF’s push for transparency in revenue administration.

The Washington-based lender set a goal for the nation’s tax revenue to rise to 3.46 trillion taka ($32 billion) by June. The government has managed a collection of only 2.47 trillion taka in the 10 months through April even though it fixed a target of 3.70 trillion taka for the year.

Subsidy Cuts

Subsidy cuts, which are a major requirement for the IMF program and usually cover electricity, food and agriculture, accounted for 12.2% or 827.45 billion taka of this year’s budget.

The government has already hiked electricity prices three times this year. Kamal said a subsidy adjustment mechanism for power and agriculture will be finalized by September, though he warned the government’s subsidy spend will take time to go lower due to accumulated arrears. For the power sector in particular, the government intends to phase out the payment of minimum capacity charges to private producers.

Inflation Path

Consumer prices rose 9.24% in April, surpassing the government’s target of 5.6% for this fiscal year. Kamal set an inflation target of 6% for the new year, lower than the 6.5% estimate by a Finance Division panel as global commodity prices eased.

While the new target takes into account the gradual removal of subsidies, higher inflation could well become a political headache for Hasina and her government. The largest opposition group, the Bangladesh Nationalist Party, continued street protests for months over the soaring costs of living, blaming it on the government’s economic mismanagement and demanding that Hasina step down to make way for a caretaker government.

Growth Goals

The budget is seeking a path for the economy to expand by 7.5% next fiscal year, and eventually graduate from being a least developed country in 2026.

The government had initially targeted that pace of growth this year, but pared it to 6.5% as Russia’s prolonged war in Ukraine raised food and fuel costs and weakened the global economy.

--With assistance from Eltaf Najafizada and Vrishti Beniwal.

(Updates throughout.)

©2023 Bloomberg L.P.