Sep 8, 2022

BoC puts down goal posts for future path of interest rates

, Bloomberg News

BoC's Rogers taking questions from media

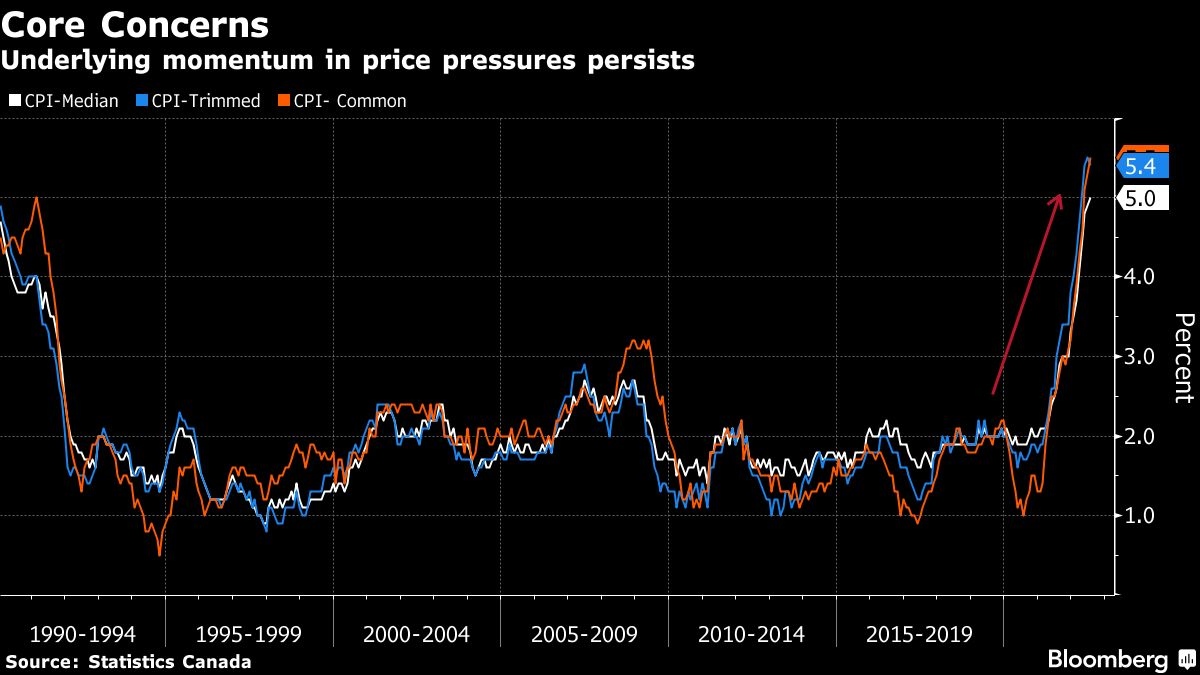

The Bank of Canada laid out key markers it will be watching as it considers how high borrowing costs will need to rise, flagging inflation expectations and underlying momentum of price pressures.

In a speech Thursday in Calgary, Senior Deputy Governor Carolyn Rogers said policy makers will be closely monitoring how consumption, global supply disruptions and inflation measures evolve as interest rates reach a level that starts to actively slow economic growth.

“Our primary focus will be to judge how monetary policy is working to slow demand, how fast supply challenges are resolved, and most importantly, how both inflation and inflation expectations respond,” Rogers said in prepared remarks.

In her second speech since taking the No. 2 job at the central bank, Rogers reiterated that borrowing costs will need to rise further given the outlook for inflation. She also noted that strong consumption and business investment, as well as a tight labor markets are evidence the Canadian economy continues to overheat.

“Because we are in a period of excess demand, we need a period of lower growth to balance things out and bring demand back in line with supply,” Rogers said.

In a press conference after the speech, the senior deputy governor said the bank believes there is room for growth to cool but stay positive. “We continue to see a path to a soft landing,” she said, adding that the path remains narrow.

The comments, coming a day after the bank delivered a 75-basis-point hike to its policy interest rate, outline key considerations for officials as they continue one of their most aggressive hiking cycles ever. Benchmark borrowing costs now sit at 3.25 per cent after holding at an emergency pandemic low 0.25 per cent until March.

That aggressive jolt of monetary tightening was intended to prevent more acute economic pain. “By front-loading interest rates now, we’re trying to avoid the need for even higher rates down the road and a more pronounced slowing of the economy,” she said.

Asked about the potential for further outsized increases to borrowing costs, Rogers stopped short of ruling out further moves larger than 25 basis points. “We’ll take the next decision when it comes.”

The senior deputy governor said the bank will be eyeing core measures of inflation and survey results on expectations in order to assess how “broad and entrenched price pressures are.” The evolution of supply chain bottlenecks, which the bank sees as improving, and labor-shortage indicators will also be monitored.

Rogers also said policy makers expect consumption of goods and services to slow, adding that the savings amassed by Canadians during the pandemic present a “risk that consumer spending has more momentum than we expect.”

Wednesday’s 75-basis-point hike leaves Canada with its highest policy rate since 2008, and brings borrowing costs to a level the central bank believes will start to actively cool the country’s economy. (The so-called neutral range for rates, which neither stimulates nor restricts activity, is estimated to be between 2 per cent and 3 per cent.)

Markets are betting policy makers will keep hiking interest rates above 3.75 per cent before the end of this year.