Jun 5, 2023

Canadian Solar Bucks Economic Tide With Shanghai Share Offering

, Bloomberg News

(Bloomberg) -- Shares of CSI Solar Co. are expected to start trading in Shanghai sometime this week or next, making the subsidiary of Nasdaq-listed Canadian Solar Inc. an outlier as China stocks struggle and US renewable energy companies soar.

CSI Solar sold 541 million shares last week to raise 6 billion yuan ($845 million) in China’s fifth-largest initial public offering this year. The stock represents a 15% stake in the company, which will remain majority-owned by Guelph, Ontario-based Canadian Solar.

Chinese equity indexes are trailing both their Asian and US peers this year. Canadian Solar is listed on the Nasdaq Stock Exchange, where the Nasdaq 100 Index is up 34% in 2023. By comparison, the Shanghai Exchange Composite Index has climbed 4.6% this year.

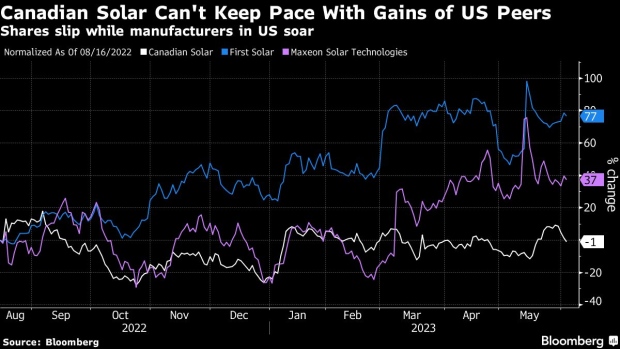

Canadian Solar has traded roughly in line with the Nasdaq 100 this year. But because its facilities are in China, it has missed out on the surge in renewable energy stocks triggered by the US Inflation Reduction Act, which rewarded companies for building up their manufacturing bases in the US.

The law passed on Aug. 16, and since then shares of Canadian Solar, which trade under the ticker CSIQ, are down 1%. Meanwhile, First Solar Inc. has soared 77% and Maxeon Solar Technologies Ltd. is up 37%.

That could explain why CSI is listing in China.

“We see the success of the China IPO as a key milestone for CSIQ to obtain access to low-cost of capital in the current capital-constrained environment,” Roth MKM analyst Philip Shen wrote last week.

The IPO valuation exceeded Shen’s expectations by $280 million and values Canadian Solar’s remaining 64% stake in CSI Solar at $3.6 billion. He boosted his price target on the parent to a Street-high $70 from $55 a share.

NOTE: May 30, Canadian Solar’s CSI Solar IPO Prices on Shanghai Stock Exchange

CSI is planing to invest the IPO proceeds entirely in China.

“We are not going to fund US manufacturing through the proceeds from the China IPO,” Chief Executive Officer Shawn Qu said on the company’s May 18 earnings call. He noted that Chinese IPOs must specify the funding uses and that plans for a US manufacturing plant “are going to be funded with other sources of funding,” without giving details.

Roth MKM’s Shen said he expected cash and prepayments from long-term customers in the US are “sufficient to fund its US capacity expansion plan.”

--With assistance from Yiqin Shen and Filipe Pacheco.

©2023 Bloomberg L.P.