Aug 7, 2020

Charting the Global Economy: U.S. Job Market Makes More Progress

, Bloomberg News

(Bloomberg) -- Employers in the U.S. are continuing to add to headcounts as demand slowly returns, while the U.K. central bank sees its country’s jobless rate rising to 7.5% by year-end. Meanwhile, Vietnam, China and Taiwan are seen as the brightest economies in Asia.

Here are some of the charts that appeared on Bloomberg this week, offering insight into the latest developments in the global economy:

World

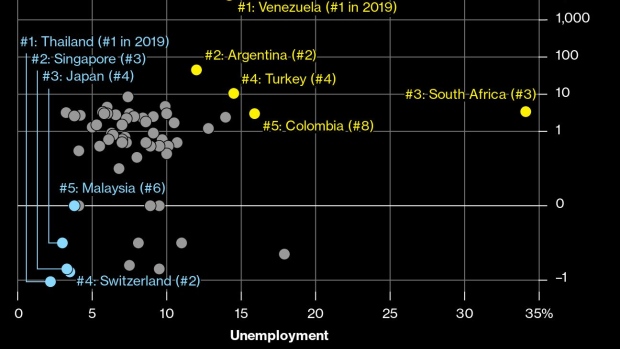

Almost all of the 60 economies surveyed for the Bloomberg Misery Index, which tallies inflation and unemployment outlooks, are projected to be more miserable this year amid Covid-19, with analysts expecting increased joblessness and tepid growth. The U.S. is projected to see the worst reversal of fortune this year in the ranking.

U.S.

America’s job market continued to regain ground in July, though at a slower pace, indicating the economic rebound is still making headway despite a surge in coronavirus infections. Payrolls are still down 13 million from pre-pandemic levels.

The latest survey of manufacturers by the Institute for Supply Management showed lean inventories may be more commonplace throughout the economy, which could help underpin production. The share of purchasing managers at factories who say their customers’ stockpiles are too low was the second-highest in a decade.

Europe

U.K. unemployment is set to reach 7.5% by year-end after government wage subsidies keeping millions of workers in their jobs are phased out, according to the Bank of England. But the central bank is less pessimistic than the Office for Budget Responsibility, the fiscal watchdog.

The vacancy on the six-person Executive Board of the European Central Bank the departure of Luxemburg’s Yves Mersch will create in December will be the last until 2026. With citizens of all four of the region’s biggest economies already on the board, Mersch’s exit offers a rare prize to the rest.

Asia

China’s inflation is set to drift down in the months ahead as food prices cool and slack household demand saps strength from prices of goods and services. Bloomberg Economics thinks CPI will be around zero by end-2020 on a year-over-year basis.

Only three economies across Asia -- Vietnam, China and Taiwan -- are expected to see growth this year, according to median economist estimates in a Bloomberg survey.

Emerging Markets

Activity in emerging markets excluding China remained 35% below the pre-virus level at the beginning of August, according to Bloomberg Economics gauges that integrate high-frequency data such as credit-card use, travel and location information.

©2020 Bloomberg L.P.