Jan 25, 2024

Crypto Fans Lured by 20% Stablecoin Yields Even After 2022 Bust

, Bloomberg News

(Bloomberg) -- The same type of investment product that led to widespread disaster in the cryptocurrency market in 2022 is proliferating once again.

It involves a tantalizing ambition that, in theory at least, sounds simple on paper: Create a so-called stablecoin that tracks the US dollar one-to-one while paying investors yields that are competitive with those available in traditional markets.

The spectacular implosion of the TerraUSD stablecoin — and the subsequent string of bankruptcies of firms dependent on the nearly 20% yields once offered by a related project — laid bare how risky such investments can be.

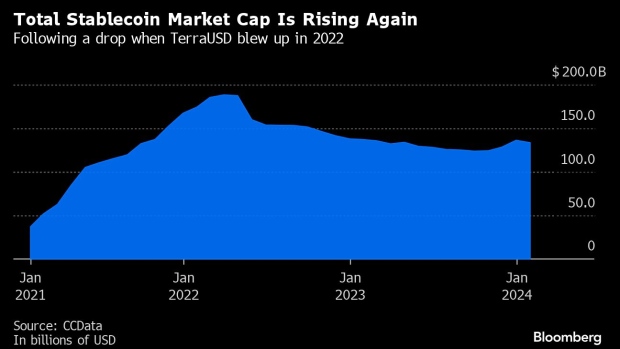

Yet memories can be short in the crypto world. And as Circle Internet Financial Ltd., the issuer of the USDC stablecoin, creeps closer to an initial public offering and Tether Holdings Ltd., the distributor of the largest stablecoin USDT, builds up its massive reserves, this corner of the crypto market is once again capturing the attention of venture capitalists, founders and customers. Trading volume for stablecoins on centralized exchanges surged 28% to $995 billion in December, reaching its highest point of 2023, according to CCData.

“It is starting to become a category where you have to have a horse in the race,” said Martín Carrica, chief executive officer of stablecoin company Mountain Protocol.

As crypto players aim to profit off of the renewed interest in stablecoins, they’ve turned to yield-bearing products that some worry may cause the tokens to be much-less stable than their name implies. These projects, some of which offer interest rates of more than 20%, have raised concern that holders will be stranded with worthless tokens if the mechanics behind them collapse — which was the case with TerraUSD. They’ve also triggered alarm bells regarding securities regulations in the US.

“The yield component raises US federal securities-law issues unique to these types of products, which is why the majority of these are offered exclusively offshore,” said Michael Selig, partner at law firm Willkie Farr & Gallagher LLP.

Regulatory Hurdles

While there is currently no federal statutory structure that directly addresses stablecoins, which are typically pegged to an asset like the dollar, Selig noted that “unregulated” stablecoin issuers, including those with yield-bearing tokens, typically don’t hold US licenses and do not offer their products to investors in the US. That doesn’t mean Americans are unable to access these digital assets.

“They attempt to avoid the registration and licensing requirements by only issuing and redeeming directly offshore, but allowing the stablecoins to flow into the US through secondary sales,” he said.

There’s significant precedent that the US Securities and Exchange Commission considers these types of coins to be securities, according to Ashok Ayyar, counsel at Ashbury Legal. He pointed to a December enforcement action from the SEC, in which BarnBridge DAO agreed to pay a $1.7 million settlement and cease selling a structured-finance crypto product that the regulator found to be an unregistered security.

“Yield-bearing instruments are generally securities,” Ayyar said.

One company has tried to preemptively work with the SEC to offer an interest-bearing stablecoin, which typically involves the issuer investing funds paid by purchasers of its token and then passing part of the returns back to the stablecoin holders as interest. Figure Technologies Inc. filed with the regulator in October to introduce an interest-bearing stablecoin in the US, Bloomberg reported Monday.

Yet when assessing the broad landscape of interest-bearing stablecoins, the tokens are “on the higher end of the risk curve” for consumers, according to Nathan Allman, CEO of Ondo Finance, which offers USDY, a tokenized note unavailable in the US that’s similar to a stablecoin with a variable interest rate.

“It’s a little suspicious whether [they are] a suitable long-term strategy,” he said.

Venture Craze

Still, these risks and lack of regulatory clarity haven’t dissuaded venture capitalists, who have poured billions of dollars into the crypto industry over the years and these day are fielding a plethora of pitches related to stablecoins.

At Castle Island Ventures, founding partner Nic Carter said his firm’s last five deals, including Mountain Protocol, have all been related to stablecoins. “It’s my number one sector right now,” he said, noting that the tokens have much potential for use by fintech companies as well as for remittances and payments on mobile apps.

Carter said he’s particularly excited about interest-bearing stablecoins. He said these products are gaining traction in Latin America, where customers may not have access to stable currencies, US banking accounts, money-market funds, Treasuries or other savings vehicles.

“The target audience is basically middle- or upper-class folks in emerging markets that just don’t have access to dollar rails at all,” he said.

New Launches

Mountain Protocol’s Carrica got into stablecoins after experiencing inflation and currency instability in his native Argentina. Domiciled in Bermuda and regulated by that country’s monetary authority, Mountain Protocol launched its USDM coin in September. The token, which Mountain Protocol doesn’t offer to US customers, can provide interest rates of around 5% and is now the 12th-largest stablecoin by market capitalization, according to crypto data tracker DefiLlama.

“Mountain Protocol is an effort to build the closest proxy to a high-yield checking account for the world,” Carrica said.

Some people within the crypto industry have “PTSD” following the collapse of TerraUSD and its sister Luna token in 2022, according to Carrica. The de-pegging of the TrueUSD stablecoin from the dollar even sparked flashbacks earlier this month.

Carrica said Mountain Protocol has taken steps to prevent a similar debacle and has a wind-down plan in place. “From a solvency perspective, we always aim to pay less than we’re making on the asset side,” he said.

Other startups are more hesitant to classify their products as interest-bearing stablecoins amid regulatory uncertainty. Portugal-based Ethena touted its USDe currency — with which investors can earn a yield via a related app — as a stablecoin in July before switching gears in October. The company, which recently raised $6.5 million and is about to announce an additional round of funding, now prefers the term “synthetic dollar,” according to CEO Guy Young.

USDe is currently available to VCs and hedge funds, but Ethena plans to publicly launch the token by the end of the month, according to Young. He said the company uses customers’ staked ETH as collateral. (Staking ETH involves locking up tokens to help manage the “proof of stake” network in exchange for payments, similar to the rewards paid to Bitcoin miners.)

“We take that collateral, send it to a custodian and hedge exposure on an exchange — shorting exposure to the same asset,” he said.

The yields earned from this strategy then get passed on to users through the Ethena app, which is not available in the US. Yields for USDe reached 26% in December before falling to the high teens this month, according to Young.

“The risks of this product look very different to a normal stablecoin,” Young said.

©2024 Bloomberg L.P.