Sep 29, 2023

Crypto’s First Year After the FTX Blowup: ‘It’s Been Miserable’

, Bloomberg News

(Bloomberg) -- Sara Feenan took the plunge in 2017, leaving a career in finance for the brave new world of crypto.

Feenan, whose stints over the years included a blockchain technology company and the Binance exchange, was excited to be part of a movement that promised to remake and improve seemingly everything. She even named her dog after the inventor of Bitcoin. Then came the convulsions of 2022, capped by the spectacular blowup of the FTX exchange last November. As the fallout spread in the months that followed, Feenan, whose latest gig was at a startup, found herself out of a job. She left crypto after that.

“I got a bit disillusioned,” says Feenan, who now works at a non-crypto fintech startup in London. “There was a bit of exasperation with things like FTX. If you tell people you work in crypto and that’s just happened, it’s very hard to say not everyone is there to scam people.”

While that cloud of skepticism and suspicion has hung over the asset class from the beginning, it’s perhaps never been thicker than in the months since the downfall of FTX and its enigmatic leader Sam Bankman-Fried. The cloud isn’t likely to lift anytime soon as Bankman-Fried prepares to face trial next week for what prosecutors allege was one of the biggest financial frauds in US history. He has pleaded not guilty to the raft of charges against him.

Of course, nothing affects the mood in markets more than price. While Bitcoin has rebounded some 60% this year to trade at about $27,000, it’s still well below its record of $69,000 reached in November 2021, ago and has been mired in a trading range for most of the year. What was once almost a $3 trillion market is now worth about $1 trillion. And any dream of Bitcoin or any other crypto token serving as a true alternative currency has remained just that.

Read more: The Crypto Fraud Case Against Bankman-Fried and FTX: QuickTake

Trading has dried up, and once-hot corners of the market like non-fungible tokens now look like the digital tulip bulbs that critics always said they were. Some 95% of more than 73,000 NFT collections are essentially worthless, according to researchers at dappGambl. Weekly traded value of NFTs was around $80 million in July, just 3% of the peak seen in August 2021, the researchers write, citing data from the Block. Remember NBA Top Shot, the much-hyped Dapper Labs NFT project that turned basketball highlights into tradable tokens, some of which sold for more than $200,000 back in 2021? There are now hundreds of them languishing for sale with asking prices of $1.

Read more: NFTs, Once Hyped as the Next Big Thing, Now Face ‘Worst Moment’

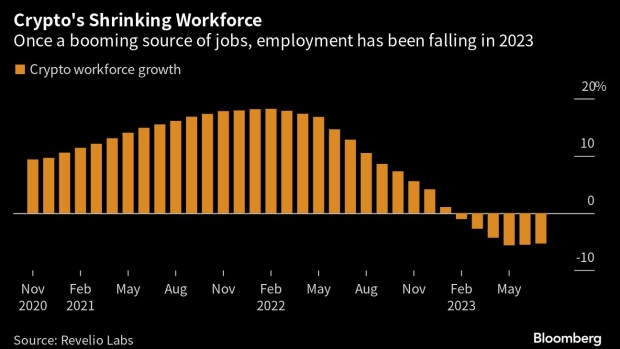

Crucially, the formerly loose purse strings of the venture-capital world have tightened considerably. VC deals targeting cryptocurrency and blockchain projects have shrunk to about $7.3 billion in total this year through Sept. 19, about a quarter of the full-year tally in each of 2021 and 2022, according to Pitchbook data. And jobs in the industry are disappearing. While the crypto workforce grew at a pace of more than 18% in early 2022, employment has been declining all year, most recently at a rate of more than 5%, according to data from workforce intelligence company Revelio Labs based on 35 large companies.

“I’ll be honest and say it's been miserable,” said Nico Cordeiro, chief investment officer of crypto hedge-fund Strix Leviathan. “The revenue is minimal just because of the conditions in the market. You're not bringing in new investors because nobody's investing in the space. The players in the space are kind of in survival mode: Keep operations going for as long as it takes for capital to start returning to the space.”

Strix Leviathan, which had used FTX’s offshore exchange to trade the perpetual crypto futures that are unavailable on US exchanges, still has funds locked up, via a prime broker, in the bankrupt exchange. It has since stopped trading perpetual futures out of concern there are no safe venues to do so, as FTX’s main rival Binance comes under increasing regulatory scrutiny itself.

For those who have been able to successfully launch a crypto-related venture in the post-FTX era, it’s been a tough road. Hilal Diab started his Tel Aviv-based company Market Mapper, a blockchain-analytics platform for traders, in January. But he quickly encountered trouble finding a major online advertising platform that would take his business. And he says that when he tried to sign up with Mailchimp to distribute Market Mapper newsletters, the company told them to find another service provider because it didn’t want to be associated with the crypto sector. Even his friends and family are wary.

"As soon as I tell someone my startup is related to crypto, they clench up. That is the first reaction I get," he said. “You also have investors who are very skeptical to give us money, especially after the FTX crap. They are afraid of lawsuits."

Those lawsuits and assorted other cases have piled up in the wake of FTX’s collapse and the crypto meltdown that preceded it last year. In addition to FTX’s own bankruptcy and Bankman-Fried’s upcoming criminal case, crypto firms Genesis Global, Celsius Network, Voyager Digital, Three Arrows Capital and BlockFi Inc. have all been embroiled in bankruptcy and related legal proceedings. On Friday, Three Arrows’ co-founder Su Zhu was detained in Singapore and faces potential jail time along with co-founder Kyle Davies for failing to cooperate with the liquidation investigation around the defunct hedge fund, according to liquidators at Teneo.

Coinbase Global Inc., meanwhile, is fighting the SEC over allegations that many of the cryptocurrencies traded on its exchange are unregistered securities, while lobbying Capitol Hill relentlessly and making inroads overseas.

Binance, meanwhile, is mired in enforcement actions by the Commodity Futures Trading Commission and SEC. Even Bankman-Fried’s parents are getting pulled into litigation with a lawsuit meant to claw back money they received from FTX.

Yet surprisingly, the courts also have been a rare source of optimism that has likely helped cryptocurrency prices find a floor, according to Georgetown University finance professor Reena Aggarwal. She cited an appeals court ruling last month that overturned the SEC’s decision to block Grayscale Investment LLC’s proposed spot-Bitcoin exchange traded fund, and another judge’s ruling that Ripple Labs’ XRP token isn’t a security when sold to the general public.

“The SEC has been trying to enforce and say that crypto is the Wild West and we need to regulate, but the courts have pushed back,” she said. “That has given the industry a new life in a sense.”

Next comes Bankman-Fried’s turn in court and a re-airing of FTX’s dirty laundry. Many in the industry will keep a close eye on the trial to see if any new details are revealed, according to Brian Mosoff, chief executive officer of Toronto-based Ether Capital Corp., which invests in crypto and blockchain projects. Yet to Mosoff, the challenges facing the industry in the post-FTX era may also mark an important turning point.

“The silver lining here is it just advances that conversation in every jurisdiction globally because everyone realizes this industry is not going to go away,” he said. “You can imagine there’s a pre-FTX digital-asset industry and then a post-FTX digital-asset industry. And I think that this will go down potentially in history as a marking point for when the industry became institutionalized, credible and regulated.”

Indeed, with BlackRock Inc., Fidelity, Franklin Templeton and others hoping for eventual approval of their spot Bitcoin ETFs, and traditional Wall Street firms busy with blockchain projects aimed at turning traditional assets into digital tokens, the future of crypto innovation has arguably never looked more institutionalized.

As for Feenan — the crypto exile in London whose own dog Toshi is named for Satoshi Nakamoto, Bitcoin’s mysterious inventor — she’s not ready to write off the digital-asset industry forever.

“Crypto can swing from the profound to the very silly, very quickly,” she says. "I would come back if something interesting came up, if I think this project is going to help move the needle."

--With assistance from Stephanie Davidson and Jody Megson.

(The 12th paragraph was updated to add news of the arrest of Three Arrows’ co-founder Su Zhu)

©2023 Bloomberg L.P.