Aug 5, 2021

Czechs Set to Raise Rates and Outline More Hikes

, Bloomberg News

(Bloomberg) -- The Czech Republic will probably take another step in one of Europe’s most aggressive monetary tightening campaigns and outline a path for more interest-rate hikes as inflation overshadows worries about the pandemic.

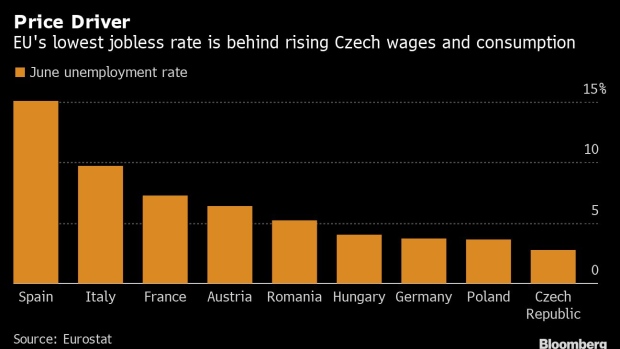

With an overheating labor market and an inflation rate that’s already testing the central bank’s tolerance, officials are concerned that supply-chain bottlenecks and high commodity prices may push consumer prices even higher.

The policy panel, which raised the key interest rate in June by a quarter point, is expected to do so again to 0.75% on Thursday.

“Labor shortages have become a real issue for businesses, strengthening inflation risks,” said Mai Doan, a London-based economist at Bank of America Corp., who predicts three hikes by the end of the year and five more in 2022. “The current backdrop is not very far from the pre-Covid situation.”

The country of 10.7 million people has more job vacancies than those without work even after a hard four-month lockdown that ended this spring. Inflation has remained above the 2% target throughout the pandemic, and pent-up demand is now adding pressure on prices.

Read more: Top Czech Rate Setter Challenges View of ‘Transitory’ Inflation

The hawkish approach -- also shared by Hungary, whose central bank delivered its second rate hike last week -- contrasts with prolonged monetary stimulus in the euro area and neighboring Poland, where central banks say current inflation pressures will ease with time.

Policy makers in Prague have earned a reputation for making fast and bold moves to manage inflation. When the pandemic hit the Europe last year, they cut interest rates by the most in the European Union, reversing the bloc’s biggest campaign of increases during the previous three years.

Governor Jiri Rusnok was quoted as saying he favored a rate increase in August, and Deputy Governor Tomas Nidetzky said last week he “can imagine” raising rates at each subsequent policy meeting until new factors emerge that will stop the cycle.

The central bank will also present its quarterly update of economic forecasts on Thursday, which will outline the future rate path. The previous outlook implied three quarter-point increases in total for this year.

Money-market bets show investors are positioned for at least three hikes this year and a total of five increases over the next 12 months.

“Economic development is favorable, inflation remains high, with an outlook for further acceleration,” Jiri Polansky, an analyst at Erste Group Bank AG’s Czech unit Ceska Sporitelna. “Also, the pandemic situation still isn’t worsening significantly.”

©2021 Bloomberg L.P.