Apr 5, 2023

Dubai’s Unstoppable Luxury Housing Market Just Set Another Record

, Bloomberg News

(Bloomberg) -- For the world’s rich looking for places to stash their wealth, one segment of Dubai’s real estate market is increasingly the destination of choice: apartments and townhouses with a brand name, like Four Seasons, Bulgari and Cavalli.

Sales of those properties are booming in Dubai, which has become the world capital of so-called branded residences as foreign buyers continue to purchase ultra-luxury homes. This week, a buyer agreed to pay 203.1 million dirhams ($55.3 million) for a five-bedroom, Baccarat-branded apartment in a project that hasn’t even broken ground yet. At 14,000 dirhams per square foot, it’s the highest price per square foot paid for a pre-construction apartment, according to Luxhabitat Sotheby’s International Realty, the broker on the property.

It breaks a record set in just February, when a five-bedroom apartment sold for 160.3 million dirhams, or 13,751 dirhams per square foot, in the Bulgari Lighthouse, according to Dubai land records. The tower will be built on a seahorse-shaped, manmade island near the jewelry brand’s hotel and resort.

Luxury real estate boomed in Dubai as the rich got richer during the Covid-19 pandemic and as Russians looked for safe havens for money after their country’s invasion of Ukraine. Prime real estate soared 89% in October from the previous year—a swift recovery from a slump that lasted from 2014 to 2020. The market turned higher so quickly it caught many off guard. Villas in a Four Seasons Residences project in Dubai that sold for about 40 million dirhams in 2021, pre-construction or “off plan,” are now worth about 100 million.

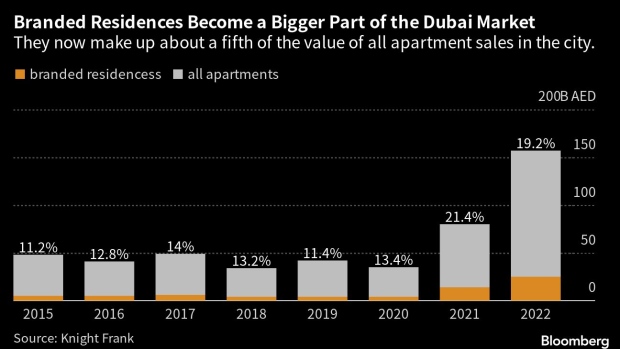

The swell push the value of branded apartments sold in Dubai in 2022 to a record 25.3 billion dirhams, making up nearly a fifth of the value all apartment purchases in the city, according to Knight Frank.

“Their popularity has been supercharged by the wall of capital from the ultra-rich that continues to target the city’s luxury homes,” Faisal Durrani, head of Middle East research for Knight Frank, said in an email.

Developers like teaming up with luxury names because they often can sell the apartments for 30% more than non-branded residences, depending on the region. The brand typically gets paid a commission of each sale and an annual management fee—not a heavy lift for putting your name on something and overseeing quality. Buyers, meanwhile, might be fans of the brand, enjoy the higher level of amenities that often far outshine non-branded developments, and they have the security of a name they can trust, especially important for pre-construction sales and those buyers who are purchasing the real estate sight-unseen from abroad. Residences also often come fully furnished.

Dubai recently overtook South Florida to become the spot with the most branded projects in the world. There are now nearly four dozen branded projects in Dubai, with a few dozen more announced and set to be built by 2030, according to a report from Savills out this week.

In the sprawling Dubai metropolis, a strip of development in and around a manmade portion of the Dubai Creek is emerging as a hotspot for these projects. Some are directly on the creek, like the 28-unit Four Seasons apartment and townhouse complex handed over to residents a few weeks ago. The ultra-wealthy buyers included tennis star Roger Federer, according to two people familiar with the matter.

Residents can use the facilities of the Four Seasons beach resort. The building’s nearly 40 staff provide housekeeping, security, valet, concierge and other services, such as grocery stocking and event planning.

“People who come from abroad, especially European, they look for quality, they look for privacy and they look for services,” says George Azar, chief executive officer of Luxhabitat Sotheby’s. “I cannot name them, but you could imagine: You have heads of states, you have top Formula 1 drivers.”

The Baccarat Residences are planned for a strip of land between the creek and Downtown Dubai, which is home to the Burj Khalifa, still the tallest building in the world. Buyers have snapped up half of the 49 available apartments, Luxhabitat Sotheby’s said.

These properties don’t come without risks. The brand name could be taken off, though it’s rare, says Scott Antel, founder of Scotts FZ, a boutique hospitality legal advisory. There are various reasons it might happen: A homeowners association might decide the management fees are too expensive. The building isn’t maintained to a high enough quality, or the hotel attached to the residential part is sold. Or, depending on the contract, the developer could switch brands before the apartments are delivered. “I find that extremely concerning, if I’m a buyer,” he said. “I buy a Ferrari and I get a Lada. And they go, ‘Hey, well, it’s still a car.’ It is an automobile, but it isn’t what I paid for.”

The brand becomes embroiled in scandal—something that could happen as luxury fashion houses, which tend to attract scandals, get into the game. Debranding is rare, but it happened in 2016 when Upper West Side residents voted to strip their Manhattan building of the Trump name.

None of the risks are deterring investors, who are buying—and already flipping some homes—as more are planned. Units in the Four Seasons residences on the creek have already been resold. And another Four Seasons residences is in the works for the city’s financial center.

©2023 Bloomberg L.P.