Sep 20, 2022

Europe Gas Falls Again as Nations Step Up Efforts to Ease Crisis

, Bloomberg News

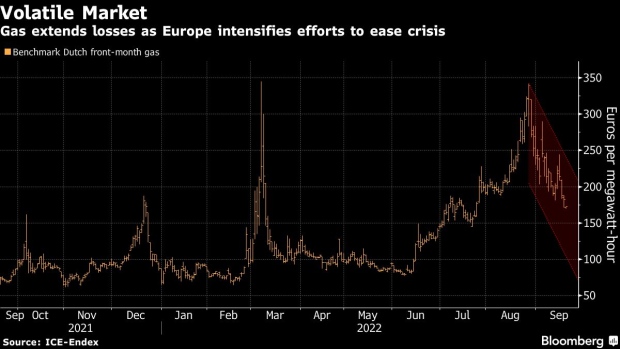

(Bloomberg) -- European natural gas prices rebounded after three days of declines, with traders weighing whether the continent’s intensified efforts to ease a winter supply crisis will be sufficient to avoid shortages.

Benchmark futures settled 6.6% higher, reversing earlier losses that saw prices fall to the lowest level since late July. Governments across the region are deploying billions of euros in funding to ensure there is enough supply, with European economic powerhouse Germany moving closer to nationalizing gas giant Uniper SE in a historic bailout.

The country is also preparing fresh credit lines for gas purchases, while Chancellor Olaf Scholz will chase new deals during his trip to the Middle East this weekend.

That builds on moves by the European Union to curb a crisis that has brought the region’s economy to the brink of recession. Separately, the UK plans to slash the wholesale prices that are incorporated into business energy bills this winter, according to people familiar with the matter. That’s in addition to a plan to cap household expenses for two years.

The market is also closely watching gas stockpiles fill steadily in Europe, to about the about 86% level, slightly above the five-year average. Together with strong imports of liquefied natural gas, that has helped prices ease from the highs of August.

Still, the threat remains of further disruptions in Russian supply, especially along the remaining major route through Ukraine. An unusually frigid winter could also tighten the market sharply, depleting inventories at the end of the colder period.

The storage build “has been very impressive,” analysts at Deutsche Bank AG said in a research note. Yet “rationing, in some shape or form, is likely” given there may be no Russian gas flowing this winter -- unless temperatures are mild, they said.

Higher demand for LNG in Asia during freezing weather will also intensify competition with Europe, potentially pushing up prices for the fuel. Japan, the world’s second-biggest importer of the super-chilled gas, is predicting its winter will trend colder.

Next year could be even harder for Europe as it will be left without the usual volumes of Russian gas needed to replenish stockpiles depleted over the winter, according to consultant Thunder Said Energy. “2023, 2024 could be worse than 2022,” it said in a note. Government moves to protect consumers from high prices may prevent demand destruction, which is needed to balance the market, it added.

Dutch front-month gas, the European benchmark, settled at 194.26 euros per megawatt-hour, after falling as much as 6.8% earlier. The UK equivalent advanced 12%, following losses last week, as traders returned after a long weekend in Britain.

©2022 Bloomberg L.P.