Aug 14, 2019

Even Cryptocurrencies Are Getting Clobbered In Today's Market Selloff

, Bloomberg News

(Bloomberg) -- Bitcoin is quickly loosing the refuge designation bestowed by some advocates in recent weeks as the largest cryptocurrency joins the global slide in riskier assets. Smaller rivals tumbled even further.

After rallying while U.S. equities plunged earlier in the month, Bitcoin has followed stocks lower, with the digital asset tumbling about 15% this week to push it’s price to around $10,100. The token, which last traded below $10,000 on Aug. 1, had climbed as high as $13,852 on June 26. Ether slumped as much as 12% Wednesday, while XRP slumped as much as 20%.

“Predictably and rationally, Bitcoin gave back much of last week’s gains, and now sits right back where we started,” said Jeff Dorman, chief investment officer of Arca, a Los Angeles-based asset manager that invests in cryptocurrencies and other digital tokens.

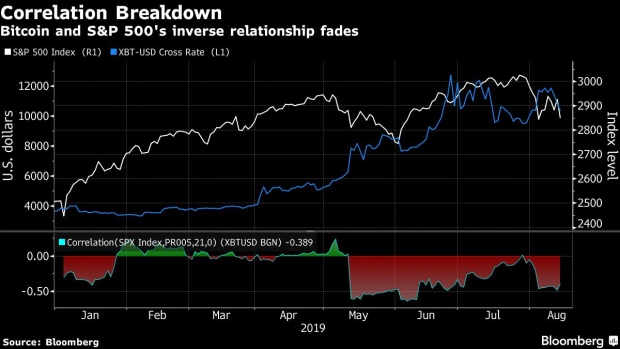

Advocates had been pointing to the increased negative correlation with U.S. equities as proof that investors were turning to Bitcoin as a haven. That narrative is unraveling this week as the inverse relationship erodes.

“It’s of course not practical to believe that every participant in global risk markets is using Bitcoin as a hedge or a flight to quality, and they are therefore not selling Bitcoin when markets go back to ‘risk on’,” Dorman said. “But since Bitcoin is such a small asset relative to the rest of the markets, it doesn’t take much to push Bitcoin one way or the other.”

To contact the reporter on this story: Olga Kharif in Portland at okharif@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Dave Liedtka, Randall Jensen

©2019 Bloomberg L.P.