Nov 12, 2018

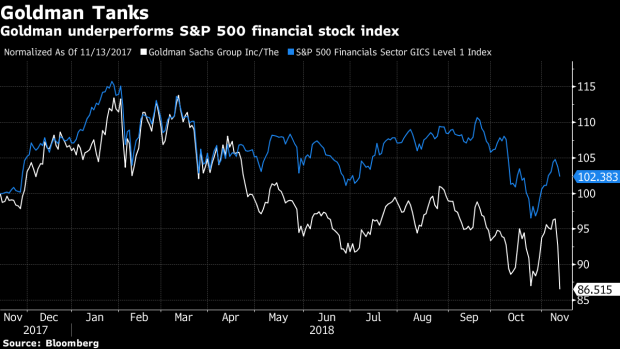

Goldman Shares Tumble to 2016 Levels With 1MDB Pressure Mounting

, Bloomberg News

(Bloomberg) -- Goldman Sachs Group Inc. shares are sinking as the bank’s troubles surrounding billions of dollars of deals for Malaysian state fund 1MDB escalate. Shares declined as much as 6.8 percent on Monday, bringing its two-day losses to more than 10 percent as the stock hit its lowest levels in nearly two years.

Concern about 1MDB may be behind the share slide, KBW analyst Brian Kleinhanzl says in an email to Bloomberg. There are “plenty of negative headlines on the deals.”

Malaysian Finance Minister Lim Guan Eng on Monday said the country is seeking a full refund of all the fees it paid to Goldman for arranging the deals, as Goldman has “admitted culpability” after former banker Tim Leissner entered a guilty plea for his role in the scandal. Leissner has said Goldman’s culture of secrecy led him to conceal wrongdoing from the company’s compliance staff.

Chairman and former CEO Lloyd Blankfein is said to have personally helped forge ties with Malaysia and its sovereign wealth fund, according to people with knowledge of the matter. Blankfein was said to be the unidentified high-ranking Goldman Sachs executive referenced in U.S. court documents who attended a 2009 meeting with the former Malaysian prime minister -- a meeting that was arranged with the help of men who are now tied to the subsequent plundering of the 1MDB fund.

Morgan Stanley shares are dropping, too, likely in sympathy. Twelve percent of the bank’s 2017 revenues were recorded in the Asia-Pacific region, according to data compiled by Bloomberg. Shares were down as much as 4 percent Monday in New York.

--With assistance from Kriti Gupta.

To contact the reporter on this story: Felice Maranz in New York at fmaranz@bloomberg.net

To contact the editors responsible for this story: Catherine Larkin at clarkin4@bloomberg.net, Brad Olesen

©2018 Bloomberg L.P.