Nov 23, 2022

Iceland Extends Western Europe’s Longest Tightening to 6%

, Bloomberg News

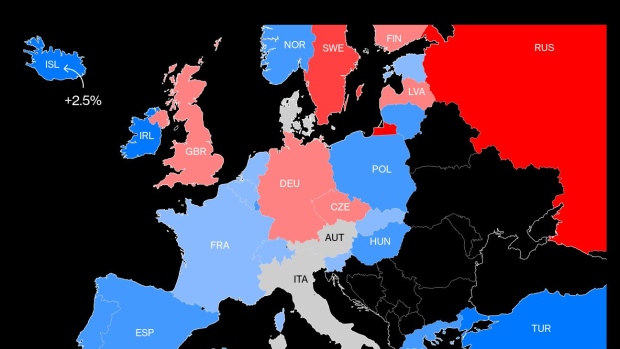

(Bloomberg) -- Iceland’s central bank raised borrowing costs to the highest since 2010, extending one of the region’s longest-lasting tightening campaigns to bring inflation under control.

The 7-day term deposit rate was increased by 25 basis points to 6% on Wednesday. The move is Sedlabanki’s 10th hike since May 2021, when it became the first central bank in to raise borrowing costs.

“Price increases are widespread, and underlying inflation has continued to rise,” the central bank said in a statement. “Indicators imply that inflation expectations have become less firmly anchored to the target, and it could therefore take longer than it would otherwise to bring inflation back.”

The decision had split forecasters at the Nordic country’s two biggest banks, Islandsbanki and Landsbankinn. The former had anticipated a 25 basis-point hike while the latter expected no change.

Iceland’s continued aggression coincides with an earlier decision on Wednesday by New Zealand’s central bank to raise by a record 75 basis points, and Sweden’s Riksbank is expected to unveil a 75 basis-point hike on Thursday. By contrast, some global counterparts may dial down their tightening. Just this week, two Federal Reserve officials reinforced expectations that US rate hiking will start slowing.

“We hope that we won‘t need to hike rates further, but of course we will hike rates if the system does not show signs of cooling,” Governor Asgeir Jonsson said at a news conference in Reykjavik on Wednesday.

Before the decision, market participants surveyed by the Icelandic central bank said that the rate had peaked at 5.75%, and would stay unchanged until cuts begin in the third quarter of 2023.

Inflation rates have eased somewhat from a peak of 9.9% in July, but price pressures remain strong.

Iceland is likely to suffer inflation averaging 8.3% this year, almost double the pace of 2021, according to OECD forecasts published this week which also showed the economy outperforming all others in the Nordic region.

According to the central bank, price growth will average 9.4% during the current quarter, halving to about 4.5% in the final three months of next year.

Officials also raised their growth forecast significantly for 2023, anticipating expansion of 2.8%.

“This is due to the prospect of more rapid growth of domestic demand than was previously assumed,” they said. “The labor market is still quite tight, although tension has eased somewhat.”

(A previous version of this story corrected the year of an OECD inflation forecast.)

(Updates with comment from the governor in sixth paragraph.)

©2022 Bloomberg L.P.