Jun 3, 2021

Japan Steel Giant Says Higher Prices Needed to Guarantee Supply

, Bloomberg News

(Bloomberg) -- Japan’s top steelmaker issued another warning to domestic manufacturing giants: accept price hikes or stable supply may not be guaranteed any more.

A huge gap has been created between international and domestic steel prices, and Nippon Steel Corp. risks falling behind, Executive Vice-President Takahiro Mori said, calling for “urgent hikes” so that the steelmaker can compete with major foreign rivals “on an equal footing.”

“Steel prices in Japan are very low, compared with internationally,” he said in an interview. “Particularly, we’ll need to urgently correct the contract prices that are settled through discussion with big users.”

While the executive didn’t name any domestic customers, the industry closely monitors the twice-a-year price talks between Nippon Steel and Toyota Motor Corp. that typically serve as a benchmark.

Steel prices have soared from China to North America amid a broader commodities boom, prompting global mills to report bumper quarterly earnings. While declining to specify the difference between overseas and domestic contract prices, Mori said the gap is “more than you could imagine.”

“Major overseas mills are benefiting from high steel prices in their home markets, but we don’t have that,” said Mori, referring to the company’s analysis of its relatively weaker profits. “In the second half of the last year, we desperately cut costs and worked hard to lower breakeven points, so I don’t think the company’s costs are higher than those of major overseas players.”

‘Unreasonably’ Low

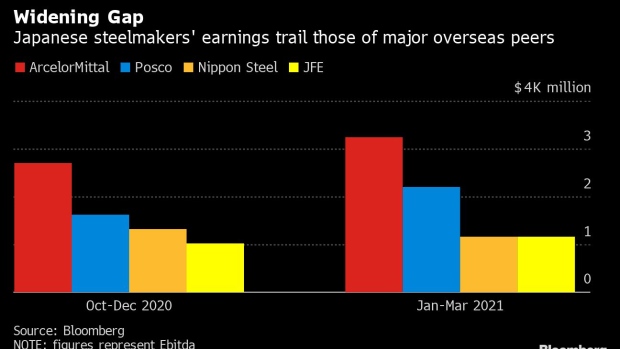

Global steelmakers have gained as an economic recovery from the pandemic gathers pace and stimulus unleashes demand. While second-half profit at Nippon Steel and its domestic peer JFE Holdings Inc. showed significant recovery, they have trailed those of major rivals such as European giant ArcelorMittal SA and South Korea’s Posco.

Nippon Steel President Eiji Hashimoto also warned last week that the Tokyo-based company won’t be able to take responsibility for stable supply unless “unreasonably” low domestic prices are corrected.

Falling behind major overseas competitors also means Nippon Steel may not be able to secure sufficient funds for new facilities and upgrading its products, particularly when a global race to develop carbon-free steel has already begun, according to Mori.

The steel market will probably tighten further toward the end of the year through March as demand increases globally and as China, the maker of more than half the world’s steel, has pledged to cut output this year, Mori said.

He said he expects iron ore to range between $190 to $200 a ton this year, while China’s benchmark hot-rolled will stay around its current level. Hot-rolled coil in Shanghai closed at 5,490 yuan a ton on Thursday.

©2021 Bloomberg L.P.