May 27, 2023

Key Takeaways From Deal Biden, GOP Sealed to Avert US Default

, Bloomberg News

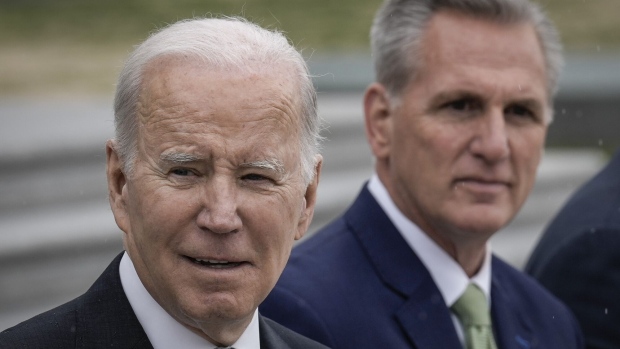

(Bloomberg) -- President Joe Biden and House Speaker Kevin McCarthy compromised on bitterly contested disputes over federal spending and assistance for the poor as part of their debt-limit deal. They must now sell the agreement to lawmakers from both parties.

Here’s a look at the most contentious and economically consequential provisions of the legislation they unveiled on Sunday, just days before the Treasury is projected to run out of cash on June 5.

Debt-Limit Suspension

The deal suspends the debt ceiling, effectively giving Treasury unfettered borrowing authority through January 2025 before another debt-ceiling increase would need congressional approval. That’s a win for Democrats — especially Biden, who wouldn’t have to face another debt-limit battle before seeking reelection next year.

Discretionary Spending

The deal puts limits on what’s known as discretionary spending, the money Congress appropriates each year to fund federal agencies and programs. The restrictions don’t apply to mandatory programs like Medicare and Social Security.

The bill creates an $886 billion cap on security spending — including defense — and a $704 billion cap on non-security domestic spending during the 2024 federal fiscal year. Those would rise to $895 billion and $711 billion respectively in 2025.

There is dispute over precisely how the math adds up. The White House says that by using budget moves, the cap translates to $637 billion for domestic agencies other than veterans’ services — just $1 billion less than current levels. But the GOP says that the figure would be $583 billion, a much steeper decline.

Defense spending would rise next year by 3.3%, as Biden requested in his proposed budget. That is below the rate of inflation, so it doesn’t meet Republican defense hawks’ aspirations for a military build-up. But it is a break from the 2011 debt-limit deal, in which spending caps were equitably applied to defense and non-defense spending.

Many federal programs will face budget cuts next year since there will be no increase to account for inflation. Congress always has the authority to approve more spending in case of an unexpected event, such as a war or pandemic.

The agreement also aims to force Congress to complete annual spending bills. If regular appropriations bills aren’t passed by Jan. 1, the legislation provides for an automatic 1 percent cut to both security and non-security spending caps.

Work Requirements

The deal calls for a phased-in expansion of work requirements to apply to older recipients of food stamps, formally known as Supplemental Nutrition Assistance Program, or SNAP. Work requirements for food assistance would eventually apply up to age 54, instead of age 49, as current law requires. There are also changes to work requirements for cash welfare.

The White House says it scored a win by gaining exceptions to the food-stamp work requirements for veterans and vulnerable groups such as homeless people. A Biden official said the exceptions would cover about a half-million people, about the same as the number impacted by expanding work requirements.

The administration also claims as a win a provision that would end the tougher food-stamp work requirements in 2030 without additional action by Congress.

But the stricter work requirements are overall a win for Republicans, who pushed to tighten eligibility for adults seeking anti-poverty assistance. Reducing the number of people who receive benefits from those programs will save taxpayer dollars, the GOP contends.

However, these provisions of the deal likely mean some progressive Democrats will vote against it. They generally oppose kicking low-income Americans off social programs.

Energy Permitting

The agreement struck by White House and GOP negotiators makes minor tweaks to the National Environmental Policy Act, the 53-year-old law requiring federal reviews of energy projects. But broader changes sought by Republicans were omitted.

Debt-Ceiling Deal Omits Broad Overhaul of Energy Permitting

Republicans scored a win by imposing a one-year limit on environmental assessments and two years on environmental impact statements. However, extensions of those deadlines, “in consultation with the applicant,” are allowed, according to text of the legislation. Project sponsors can seek a review from courts if an agency fails to meet a deadline, according to the bill.

Mountain Valley Pipeline

The debt deal specifically accelerates completion of a multi-billion-dollar natural gas pipeline that cuts through West Virginia but has been repeatedly stalled by environmental concerns. Democratic West Virginia Senator Joe Manchin has sought for more than a year to secure a side deal for construction of the 303-mile Mountain Valley Pipeline.

The language in the debt bill would force agencies to take all necessary actions to permit the construction of the pipeline and would give the DC Circuit jurisdiction over future litigation involving the project. For years, its approvals have been challenged in the Fourth Circuit Court of Appeals.

The US Army Corps of Engineers would be required to issue a permit for the project within 21 days of the debt agreement’s enactment.

Mountain Valley Pipeline’s developers, a group led by Pittsburgh-based Equitrans Midstream Partners LP, have said the pipeline is 94% completed, but that it still needs permits to build across streams and protected habitats.

IRS Funding

The agreement redirects $20 billion of $80 billion in additional IRS funding over the next 10 years provided in Biden’s signature Inflation Reduction Act. The money was supposed to be used to improve customer service and combat cheating on federal taxes. Instead, the $20 billion will go to other non-defense spending, half of it in 2024 and the other half in 2025, according to a White House fact sheet.

--With assistance from Laura Davison, Steven T. Dennis and Josh Wingrove.

(Updates with additional detail beginning with fifth paragraph)

©2023 Bloomberg L.P.