Jan 28, 2020

Kone Makes Highest Offer for Thyssenkrupp Elevators

, Bloomberg News

(Bloomberg) -- Kone Oyj handed in the highest offer for Thyssenkrupp AG’s elevator business, as the Finnish company tries to outbid buyout firms by a wide enough margin to overcome antitrust concerns, people with knowledge of the matter said.

Kone, which has teamed up with CVC Capital Partners, offered around 17 billion euros ($18.7 billion) this week, said the people, who asked not to be identified because discussions are private.

The Kone consortium’s goal has been to outbid its private equity rivals by at least 1 billion euros, the people said. Thyssenkrupp might push for even more from the bidder group, according the people.

Kone has also given Thyssenkrupp the option of receiving all cash or a mix of cash and stock, the people said. It has offered to fully assume any antitrust risks and aims to address concerns by handing Thyssenkrupp’s elevator operations in Europe, where there is the most overlap, over to CVC, according to the people.

The pair has also offered a multibillion-euro upfront payment that Thyssenkrupp would keep even if the deal is blocked by competition authorities, the people said. Shares of Thyssenkrupp jumped 7.4% in Tuesday afternoon trading, giving the company a market value of 7.4 billion euros.

Difficult Decision

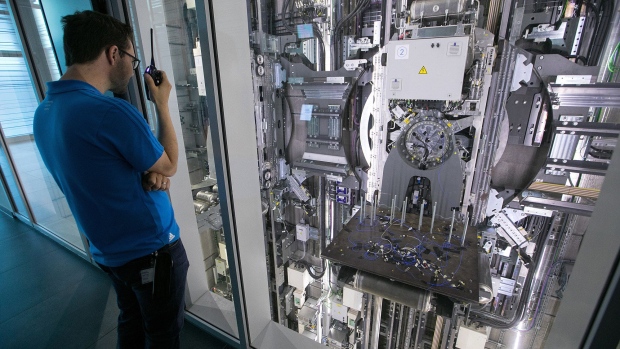

Once a symbol of German engineering prowess, Thyssenkrupp is fighting for survival amid a deep manufacturing slump. The elevator business was one of the few bright spots when Thyssenkrupp released earnings in November, which showed shrinking margins in its steel business and a worsening cash and debt position.

A representative for Thyssenkrupp and an official at Kone declined to comment, while a representative for CVC couldn’t immediately comment.

Thyssenkrupp now faces a difficult decision. The beleaguered German conglomerate is seeking to bring in as much money as possible to fund drastic restructuring measures and plug a large pension deficit. On the other hand, it also wants to avoid a long antitrust review after European regulators derailed a planned steel venture with Tata Steel Ltd. last year.

While Kone can make the highest offer due to cost savings from a combination, buyout firms would avoid competition hurdles. Kone, the only remaining strategic bidder, is competing with three remaining groups of private-equity suitors.

Its rivals include a consortium of Blackstone Group Inc., Carlyle Group LP and Canada Pension Plan Investment Board, as well as another group backed by Advent International, Cinven and the Abu Dhabi Investment Authority. Brookfield Asset Management Inc., which partnered with Temasek Holdings Pte, is also still in the running, Bloomberg News has reported.

Job Concessions

Bids so far from those groups have been under 16 billion euros, the people said. In an attempt to win over Thyssenkrupp management and shareholders, the buyout firms have been touting the lack of antitrust risk as well as a willingness to allow the steelmaker to retain a significant minority stake in the elevator business.

Some of the financial investors are also promising fewer job cuts -- and in some cases even job guarantees -- to win over influential unions, the people said.

If one of the buyout groups prevails, a deal for the business could become the biggest private-equity acquisition in Europe in more than five years, according to data compiled by Bloomberg. The next round of binding offers is expected around mid-February, and bid amounts could still change, the people said.

Thyssenkrupp is exploring a sale or initial public offering of the elevator operations, its most valuable unit, to raise cash to fund a turnaround. It’s leaning toward selling the business, though it is also still preparing for the possibility of a listing, the people said.

(Updates with share movement in fifth paragraph)

--With assistance from William Wilkes and Dinesh Nair.

To contact the reporters on this story: Aaron Kirchfeld in London at akirchfeld@bloomberg.net;Eyk Henning in Frankfurt at ehenning1@bloomberg.net

To contact the editors responsible for this story: Daniel Hauck at dhauck1@bloomberg.net, Ben Scent, Adveith Nair

©2020 Bloomberg L.P.