Oct 24, 2022

Larry Berman: Did the FOMC hint at a pivot last week?

By Larry Berman

Larry Berman takes your questions

At 8:52 a.m. EDT on Friday Oct. 21, S&P e-mini futures were down about one per cent and the U.S. Dollar was very strong versus most currencies. Many have wondered for months what it would take for the FOMC to understand that the strong U.S. dollar was a problem. Maybe it was what Johnson & Johnson said in their earnings call last week about “right-sizing” and “currency headwinds” or that consumers were starting to push back on pricing increases.

It’s probably not a coincidence that the Bank of Japan aggressively intervened in the FX market buying yen and selling dollars at the very same time the Fed leak hit the Nick Timiraos Wall Street Journal on line. The story was followed up by the following:

"I think the time is now to start talking about stepping down. The time is now to start planning for stepping down," said San Francisco Fed President Mary Daly during a talk at the University of California, Berkeley on Friday.

The strength of the U.S. dollar and the Fed’s tightening policy relative to Japan, U.K., Europe and many emerging markets has had a major impact on financial conditions. We think they blinked on Friday.

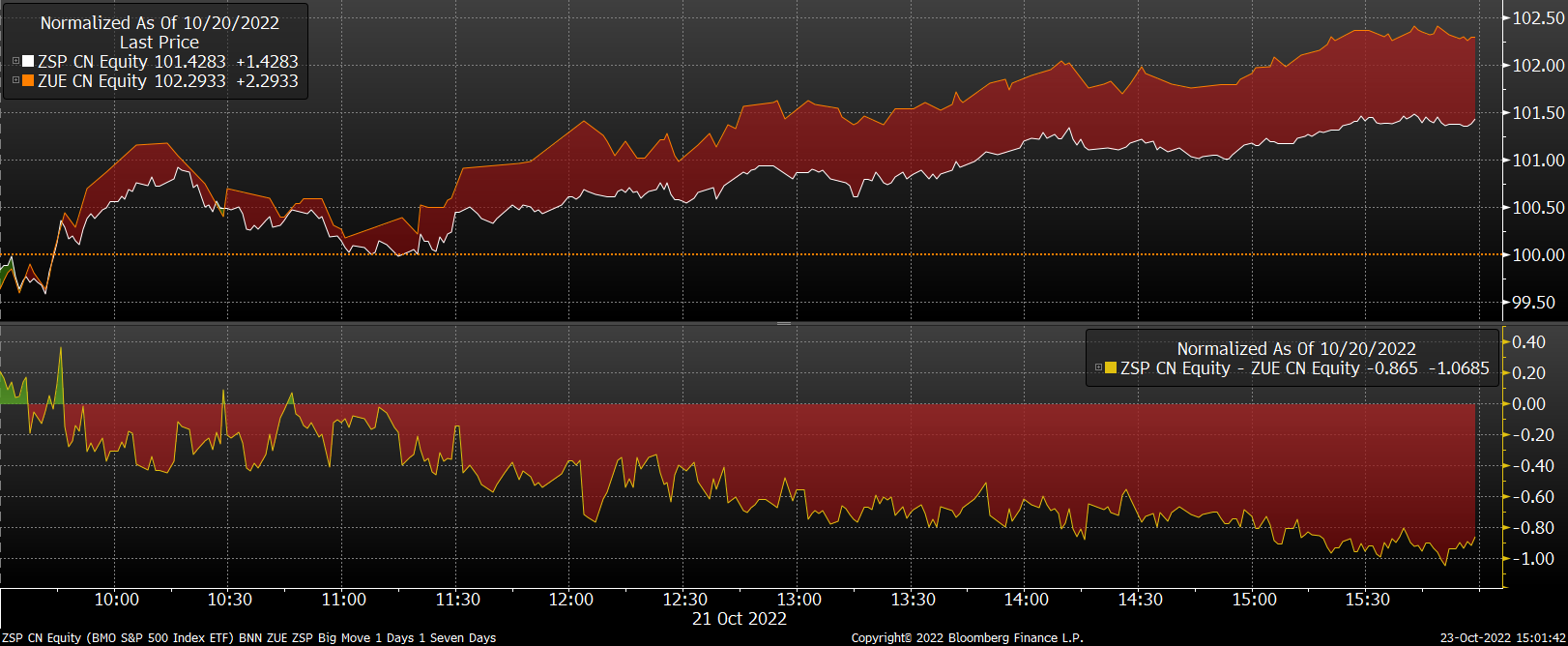

Currency markets can be a major consideration in your portfolios. The chart below shows the Canadian dollar behaviour on Friday following the Fed leaks.

So when it comes time to hedge your foreign exposure or not, having a view on central bank action and knowing what tools to use is important. The simplest example is exposure to a U.S. index like the S&P 500 on a currency hedged basis or in local currency (US$). Several ETF providers like iShares, Vanguard, BMO and others have these types of exposures for investors. In this example, we are showing the Canadian dollar ETFs. ZUE – S&P 500 currency hedged and ZSP S&P 500. As the Canadian dollar strengthened throughout the day, you can see the hedged version ZUE performed better than the unhedged version ZSP. The chart is normalized in percentage terms with a base of 100. ZUE was up 2.2933 per cent on the day versus 1.4283 per cent for the ZSP. The difference in return was all the currency impact.

We continue the fall 2022 virtual roadshow on YouTube and GoToWebinar. Sign up at https://investorsguidetothriving.com/ . We will focus on currency impacts on your returns and provide a framework for how to incorporate this important asset class into you portfolios. As always, our educational efforts on BNN support charity. Over the past decade, we have raised over $500,000 for brain health, dementia, and Alzheimer’s research at the Baycrest Hospital. You can add your donation here. I match all BNN viewer donations up to $25,000. Please help out with an assist.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com