May 7, 2019

Lyft signals no end to spending spree in first post-IPO results

, Bloomberg News

In its first financial report since going public, Lyft Inc. (LYFT.O) exceeded analysts' sales expectations but signalled no end to its spending spree.

The San Francisco-based company projected second-quarter revenue of US$800 million to US$810 million. Analysts were expecting US$782 million, according to data compiled by Bloomberg. Despite surpassing expectations, that growth rate of about 60 per cent would be a major slowdown from the previous period.

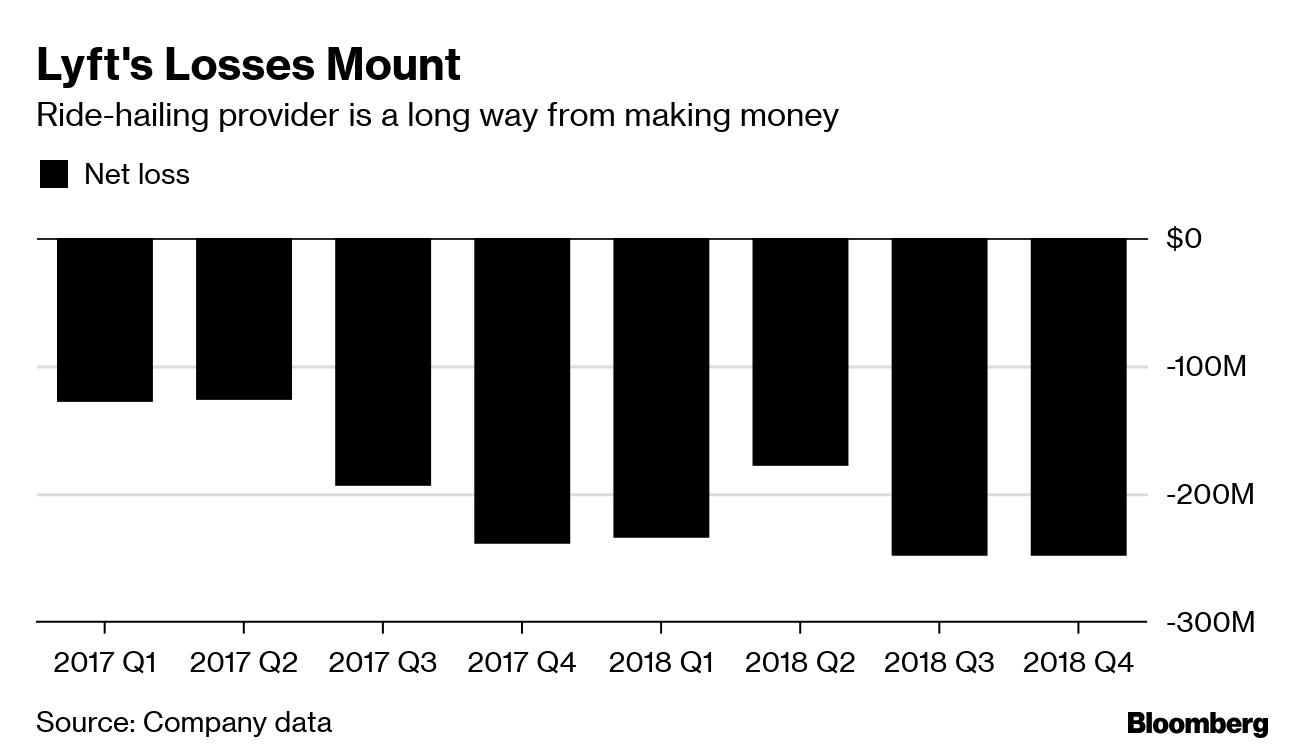

Sales grew 95 per cent to US$776 million in the first quarter, beating estimates by US$38 million. Lyft, the second-largest ride-hailing service in North America, also reported an eye-popping net loss of US$1.14 billion in the quarter, which was larger than the company’s loss for the entire year of 2018. Most of the costs were attributed to stock-based compensation and expenses tied to the initial public offering, but the numbers still unnerved some investors.

Shares were down 18 per cent from the March IPO price when the market closed Tuesday. They soared in after-hours trading and then quickly gave up those gains, as investors weighed strong growth against the giant losses to come.

The report suggests intense competition with Uber Technologies Inc. in the ride-hailing market will continue. Lyft projected a loss before interest, taxes and other expenses of as much as US$1.18 billion for 2019. It anticipates sales of US$3.28 billion to US$3.3 billion for the year, which is above estimates.

Uber had estimated about US$3 billion in revenue in the first quarter, up 19 per cent from a year before. On Tuesday, Bloomberg reported that Uber has enough demand to price its IPO shares at the top of its current range. Uber is expected to price Thursday and begin trading Friday on the New York Stock Exchange, in what’s expected to be the biggest U.S. IPO in years.

Lyft had warned investors that 2019 will be a costly year. Uber has similarly signalled that competition has further extended its losses. Investors are watching for an eventual cease-fire, but the battle for market share remains the priority for the time being, according to analysts.

In its financial statement, Lyft said active riders climbed 46 per cent to 20.5 million. Meanwhile, revenue per active rider increased 34 per cent to US$37.86. Lyft didn’t disclose gross bookings this quarter, eliminating one measure investors have used to compare the business to Uber’s. Lyft had shared an annual number in its IPO filing.

Lyft used the occasion to tout a new agreement with Waymo. The Alphabet Inc. (GOOGL.O) unit will deploy 10 autonomous vehicles near Phoenix in the next few months for customers to book through the Lyft app.