Sep 28, 2022

Micron Earnings Are Key as Apple News Points to Slowdown

, Bloomberg News

(Bloomberg) -- Micron Technology Inc. shocked investors last month by warning that rapidly slipping demand for computers would curb sales of its memory chips. On the eve of the holiday shopping season, analysts fear that business has only worsened.

Thursday’s earnings from Micron will show how bad the damage is from inflation eating into consumer budgets and cooling sales of consumer gadgets as the year’s biggest quarter kicks off. The signs aren’t good: Apple Inc. is backing off plans to increase output of its new iPhones after an anticipated surge in demand failed to materialize, people familiar with the matter said.

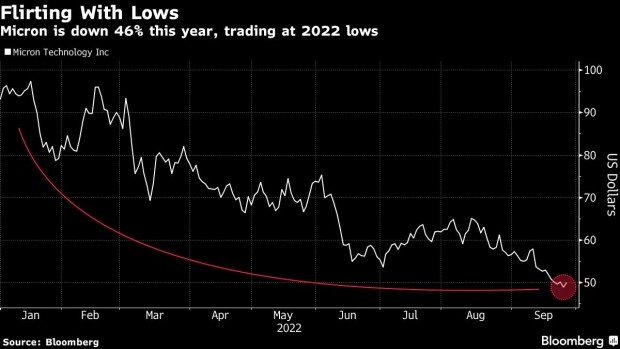

In a sign of how pessimistic investors are, Micron’s stock closed Monday at the lowest in almost two years and fell at the open. Over the past three months, analysts have cut estimates for sales this year by 6.9% and for earnings by 12%, Bloomberg data shows. They now expect revenue for the fourth quarter ended Aug. 31 to fall by 18%, which would be the first decline in 10 quarters.

“It appeared as if management was assuming a worst-case scenario” in its August earnings guidance, Matt Bryson, a Wedbush Securities analyst, wrote in a note. “In retrospect, their guide likely did not prove conservative enough.”

Micron’s woes are likely to have ripple effects. The Boise, Idaho-based company already plans to reduce spending on new plants and equipment this year, saying last month that capital expenditures will be “down meaningfully” from a year earlier. Comments on further cuts could affect makers of the equipment used to produce semiconductors, such as Applied Materials Inc. and Lam Research Corp.

With fears of a recession looming, chip stocks have seen a deeper selloff than the rest of tech. The Philadelphia semiconductor index hit a fresh low for the year on Monday. It’s down 41% from its record close in December, with all of the benchmark’s 30 components falling in that time and Micron slumping 46%.

The declines have left chip stocks looking like bargains relative, and Micron is no exception, selling for 11 times estimated earnings for the next year and 1.1 times book value. The problem is, profit forecasts still look too high to many investors.

“The stock is definitely undervalued from a historical perspective,” said Daniel Morgan, a senior portfolio manager at Synovus Trust Co. “Can it go lower? Yes.”

Tech Chart of the Day

It’s been a nightmare of a year for Meta Platforms Inc. in the stock market. The shares are down 65% from their peak a little more than a year ago and now trade at 10 times estimated earnings, their cheapest level since the Facebook owner went public in 2012. Meta is among the cheapest 25% stocks in the S&P 500 Index. The selloff this year has wiped about $574 billion in value, an amount larger than all but the six largest companies in the S&P 500.

Top Tech Stories

- The UK has “no chance in hell” of becoming technologically sovereign, Hermann Hauser, the co-founder of Amadeus Capital Partners and founder of Arm, said at Bloomberg’s Tech Summit in London.

- Apple is backing off plans to increase production of its new iPhones this year after an anticipated surge in demand failed to materialize, according to people familiar with the matter.

- Shares in Apple’s Asian suppliers extended losses Wednesday after Bloomberg reported the Californian company is backing off plans to increase production of its new iPhones.

- Elon Musk asked a federal appeals court to throw out the deal he made with the US Securities and Exchange Commission in 2018 requiring a Tesla Inc. lawyer to screen all his company-related tweets, calling it an illegal effort to muzzle him.

- Intel Corp., looking to regain its footing in the chip industry, introduced new personal-computer processors and graphics semiconductors, as well as software that makes it easier to use the company’s technology.

- Supporters of a landmark US antitrust bill gathered over beer and soft pretzels at Cafe Berlin on Capitol Hill last week to muster energy for one last push to rein in the dominance of giant technology companies. Recognizing that the measure won’t come up for a vote before the Nov. 8 midterms, the group considered on how to jam the legislation through the brief “lame duck” period after the elections.

- A hacker who infiltrated Fast Company, a publication owned by Morningstar Inc.’s billionaire founder Joe Mansueto, sent obscene push notifications to Apple News users’ home screens on Tuesday night, sparking a shutdown of the magazine’s website.

(Updates with market open)

©2022 Bloomberg L.P.