Apr 12, 2023

Muni Demand Keeps Sliding as Rate Uncertainty Shakes Confidence

, Bloomberg News

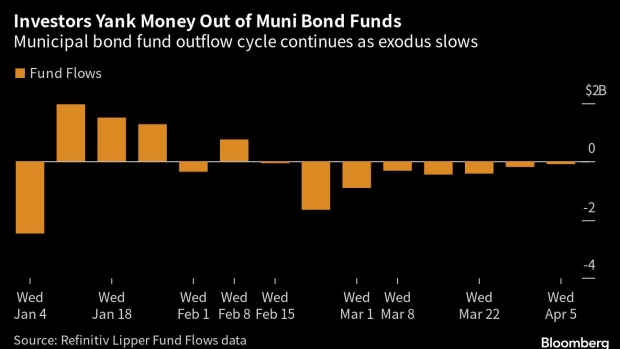

(Bloomberg) -- Investors have been pulling money out of municipal bond funds even though the asset class delivered strong returns in March.

Muni funds have seen eight straight weeks of withdrawals, with $92 million of outflows for the week ending April 5, according to Refinitiv Lipper US Fund Flows data. The exodus is unusual because retail investors tend to flee when returns are weak, but munis delivered a 2.2% return last month — the strongest performance for the month of March since 2008, according to data compiled by Bloomberg.

Portfolio managers say interest-rate uncertainty and banking turmoil have some investors on the sidelines. The Federal Reserve has been aggressively raising rates this past year to curb inflation, but recent bank failures may lead the central bank to pump the brakes on rate hikes to stabilize the financial system.

“Where we are in the interest rate environment is not an exciting time to say, ‘I should be putting money into munis right now,’” said Pat Luby, a senior municipal strategist at CreditSights.

May’s Federal Open Market Committee meeting “is key,” said Vikram Rai, head of Citigroup Inc.’s municipal bond strategy group.

Recent messages from Fed officials have been mixed. A key measure of US inflation out Wednesday points to an easing of prices, leading bond traders to increase their bets that the Fed will cut rates by the end of this year.

“If the rate market stabilizes, I think we’ll start seeing stronger inflows,” Rai said.

At the same time, a tepid equity market has slowed new investments. The S&P 500 Index is down nearly 7% this past year as of Tuesday’s close.

“There is a lack of new money, a slight increase in individual investors spending out of their portfolio, equity portfolios haven’t been growing, and a pretty good chunk of wait and see,” said Luby.

Another explanation for the recent outflows could be a flight into shorter duration securities in separately managed accounts, which aren’t reflected in fund flows data, according to Nicholas Foley, senior portfolio manager at Segall Bryant & Hamill.

That flight is a symptom of the swoosh-shaped muni yield curve. Investors can get the same yield on short securities as they can on bonds with 10-year maturities, while reducing duration risk.

“That tells me that you are seeing massive SMA buying,” Foley said. “While the actual fund flows have been negative, it appears that the SMA flows have been incredibly large.”

Rai expects withdrawals to continue for another month but is not anticipating this year to be a repeat of 2022, when muni funds lost $125 billion, according to Lipper data. Outflows have already been receding since late February.

Munis posted its worst performance since 1980 with a loss of 8.5% in 2022, according to data compiled by Bloomberg. So far this year, investors have added an estimated net $5.1 billion to municipal bond funds, including exchange-traded funds, according to Lipper.

“People are just being cautious,” said Stephanie Larosiliere, head of municipal business strategies and development at Invesco Ltd. “We can’t for certain say we won’t have another shock to the system at some point — if last year taught us anything, it’s that we don’t know.”

©2023 Bloomberg L.P.