Aug 7, 2022

New Zealand Posts First Dip in Inflation Expectations in 2 Years

, Bloomberg News

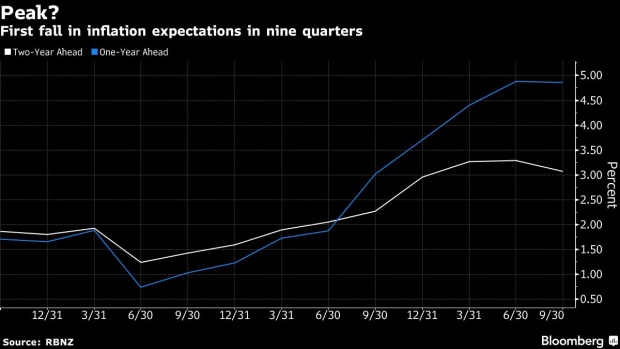

(Bloomberg) -- New Zealand recorded its first drop in two-year inflation expectations since mid-2020, adding to signs the Reserve Bank’s aggressive policy tightening is beginning to cool the economy.

Expectations fell to 3.07% in the third quarter from 3.29% in the prior three months, the RBNZ said in a quarterly Survey of Business Expectations released Monday in Wellington. The second-quarter reading was the highest since early 1991 and had been the eighth straight gain.

The central bank is forecast to deliver a fourth consecutive half-percentage point hike at next week’s meeting, taking the Official Cash Rate to 3%. The currency fell after today’s release as investors bet that easing inflation expectations may prompt policy makers to adopt a slower pace of rate increases in coming quarters.

The kiwi dollar fell to 62.4 US cents at 3:18 p.m. in Wellington from 62.6 cents before the report.

The RBNZ has expressed concern at rising inflation expectations, which have been fanned by headline inflation soaring to a 32-year-high of 7.3% in the second quarter. The central bank is required to target consumer-price growth in a 1-3% band.

Other inflation expectations gauges were little changed. The one-year ahead view eased to 4.86% from 4.88%, while the 10-year ahead outlook was 2.13% versus 2.11% three months earlier. Five-year ahead expectations fell to 2.33% from 2.42%.

©2022 Bloomberg L.P.