Jun 26, 2020

Nike shares tumble after pandemic batters sales, gross margin

, Bloomberg News

Notable Calls: Nike, Apple and Peloton

Nike Inc., which touted its ability to navigate the pandemic earlier this year, is finding it’s not so easy.

The world’s biggest athletic brand posted a surprise loss and disappointing sales in the fiscal fourth quarter, a sign that shuttered retail stores across the U.S. and much of the world took an even bigger toll than expected.

Revenue declined 38 per cent to $6.31 billion in the period ended in May, well short of the US$7.38 billion estimated by analysts. Its loss amounted to 51 cents a share, compared with a projection for earnings of 10 cents.

The results marked an about-face from earlier this year, when Nike beat Wall Street’s expectations even as many consumer brands struggled. The company made the case to investors that it was prepared to deal with COVID-19 because of its experience operating in China during the initial breakout of the virus.

Like many brands and retailers, it invested in online platforms to make up for stores being closed. But booming e-commerce sales -- digital revenue soared 75 per cent last quarter, and nearly 80 per cent when holding currency neutral -- weren’t enough to make up for the brick-and-mortar slump.

The shares declined as much as 4.5 per cent to US$96.80 in New York trading Friday. They had been up less than one per cent this year. Nike dragged down the shares of rival shoe sellers Skechers USA Inc. and Foot Locker Inc. Under Armour Inc. rose Friday after dipping in postclose trading Thursday.

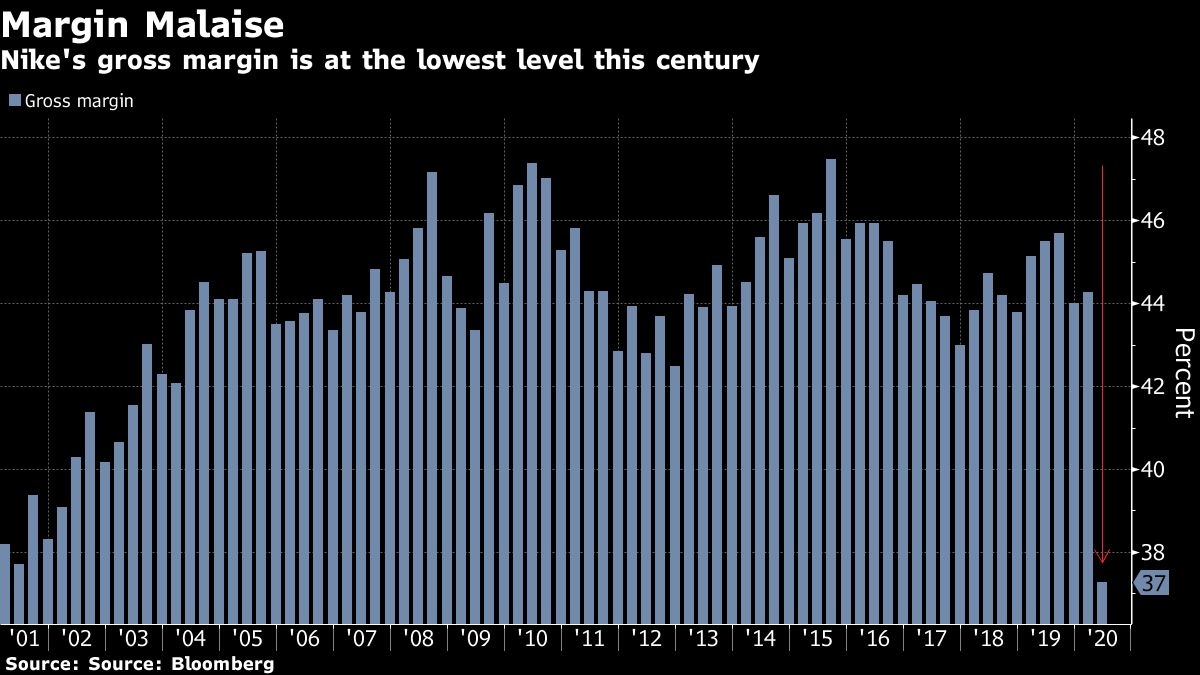

Margin Plunges

In a bid to ease fears about a prolonged slump, the company said about 90% of stores that it runs globally are currently open. The company also said sales for this fiscal year, which runs through next May, would rebound in the second half to be little changed or possibly posting a gain.

But shipments to Nike’s wholesale customers were down almost 50 per cent last quarter, hurting sales and leaving the company with excess inventory. It reported the lowest level of revenue since 2013.

Nike’s gross margin sank 8.2 percentage points to 37.3 per cent, trailing analysts’ projections of 43.5%. That was its worst performance since 1998, according to data analyzed by Bloomberg. The big hit came from higher costs tied to order cancellations and other supply-chain disruptions.

The company faces an uncertain future as the virus continues accelerating in many parts of the U.S. There also recessions of varying degrees around the world, which may reduce spending on discretionary purchases like sneakers.

In a sign of how cautious the company has become, Nike suspended share buybacks in March, even though it’s sitting on US$12.5 billion in cash.