Sep 24, 2020

Oil Rally Stutters as Demand Concerns Offset Stimulus Optimism

, Bloomberg News

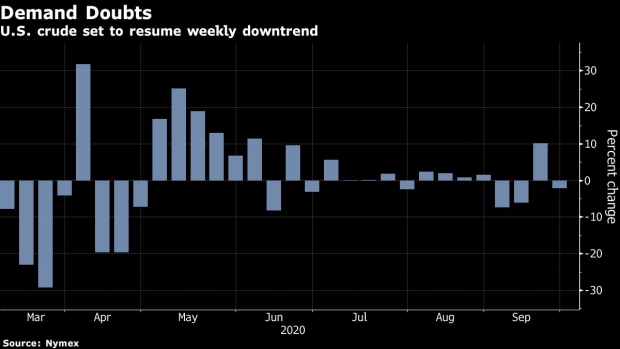

(Bloomberg) -- Oil held above $40 on renewed hopes for more stimulus measures to lift the U.S. economy out of its Covid-induced recession, although futures are on track for a weekly decline due to persistent concerns over demand.

Futures in New York fell as much as 0.5%, after gaining 1% on Thursday. Oil had tracked Wall Street higher on news that House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin were open to resuming stimulus talks, while House Democrats have started drafting a stimulus proposal of roughly $2.4 trillion, according to multiple officials. However, stocks later pared gains as investors dialed back optimism on the prospects for a compromise.

Front-month futures have lost about 2.1% this week as doubts over a rebound in consumption keep rallies in check. Lockdown measures are increasing in some parts of the world, with France and the U.K. both tightening restrictions in response to another surge in virus infections. The International Energy Agency’s Neil Atkinson said at a Bloomberg event Thursday that the agency is more likely to downgrade its demand forecasts than lift them in its next report.

Investors are also concerned over returning OPEC+ supply and production from Libya as its civil war abates. A possible collapse in the OPEC+ deal is the biggest downside price risk to the oil market, Standard Chartered analyst Emily Ashford said during a Bloomberg-hosted panel discussion.

Oil traders are reporting a sharp increase in Iraqi export cargoes for next month, as they look for clues to the country’s ability to meet its OPEC quota.

Time spreads also signal further weakness. The spreads between the two nearest December contracts for both U.S. and global benchmark crude futures moved deeper into contango on Thursday, pointing to concerns of oversupply.

Profits from turning crude into diesel remain historically weak, and some refiners are looking to close or convert plants. Total SE said its Grandpuits refinery will become a “zero-crude platform” in the coming years.

©2020 Bloomberg L.P.