Dec 8, 2021

Oil holds near US$72 as stockpiles dip, Omicron fears abate

, Bloomberg News

Gas prices may slowly stop declining once we approach Christmas: Analyst

Oil eked out a gain as research indicated that existing COVID-19 vaccines are effective against the new virus variant, quelling fears of plunge in fuel demand, while U.S. crude supplies fell slightly.

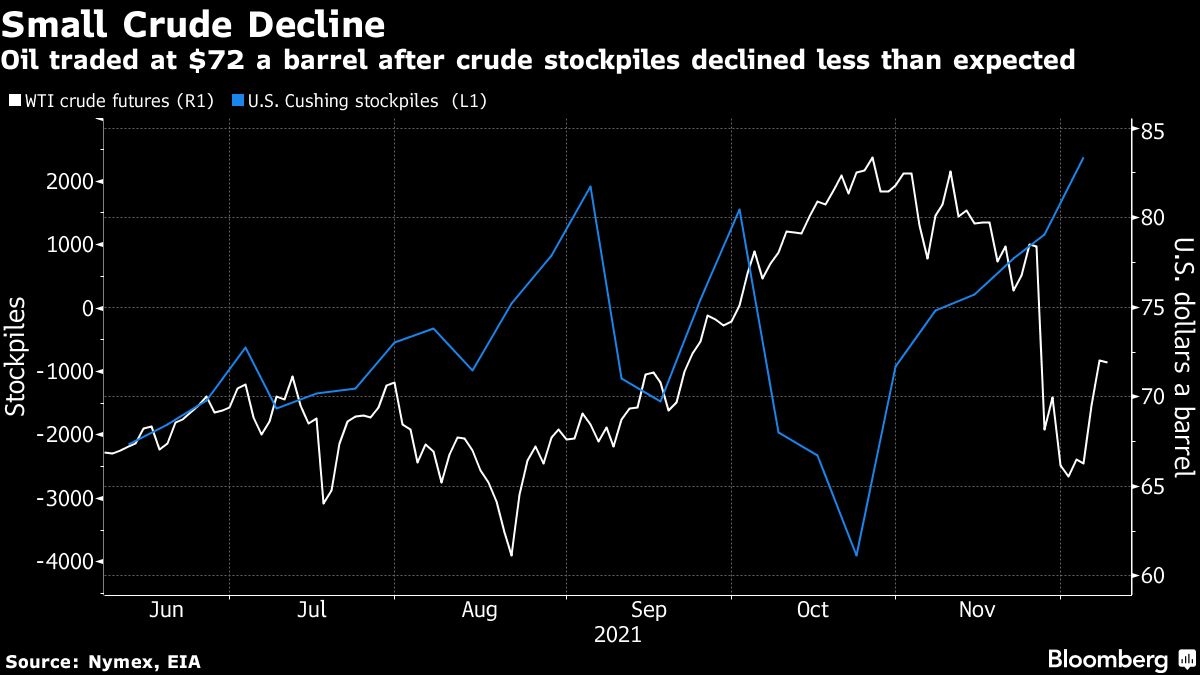

Futures in New York closed up 0.4 per cent, trading near US$72 a barrel, on Wednesday. Pfizer Inc. and BioNTech SE said initial lab studies show a third dose of their shots restores protection against the new variant. Meanwhile, domestic crude inventories fell 241,000 barrels last week, government data showed.

Crude prices have rebounded after falling into a bear market last week as nations began implementing lockdowns in response to the omicron variant, stoking concern about the impact to fuel demand. But so far, data show little sign of a significant hit to oil consumption, and OPEC+ has kept a floor under prices by keeping the door open to a possible reversal of its planned supply hike.

“Cautious optimism is prevailing that the hit from omicron on the global economy and thus energy demand will be less than initially feared,” said Stephen Brennock, an analyst at brokerage PVM Oil Associates Ltd.

Still, omicron concerns haven’t completely faded. U.K. Prime Minister Boris Johnson has tightened pandemic rules, advising people to work from home, in order to curb the spread of the variant.

China continues to tackle sporadic outbreaks, with one eastern city locking down a district to curb the spread. Omicron has led to some restrictions on air travel, and researchers in South Africa said the strain’s ability to evade vaccine and infection-induced immunity is “robust but not complete.”

Crude stockpiles rose by 2.3 million barrels at the biggest U.S. storage hub at Cushing, Oklahoma, the most since February, according to the U.S. Energy Information Administration. Gasoline inventories climbed by 3.88 million barrels.

For Cushing, “a number over two million is never good” for the energy market, said Bob Yawger, director of the futures division at Mizuho Securities USA. Inventory declines at Cushing in October and early November helped propel oil to multi-year highs, and the reversal of that trend means the prospect of futures reaching those levels again in the short term has “basically evaporated.”

Prices

- West Texas Intermediate for January delivery rose 31 cents to settle at US$72.36 a barrel in New York.

- Brent for February settlement gained 38 cents to settle at US$75.82 a barrel.

Over the past week, some traders have bet on the small chance that WTI’s discount to Brent will surge past US$10 a barrel next year. The long-shot wager is a signal that some market participants believe the Biden administration could intervene in the market again to bring down prices following a pledge to sell crude inventories from strategic reserves.

Other oil-market news:

- Buoyed by high oil prices, the bosses of the biggest explorers this week laid out a vision for the energy transition that hinges on more fossil-fuel investment rather than less.

- Saudi Arabia’s energy minister has shaped global oil markets in 2021 with his ability to spring surprises. The possibility he’ll deliver another is shoring up prices in the final weeks of the year.

- Venezuela has managed to more than double its oil production in the space of a year to 908,000 barrels a day -- a feat it’s accomplished by paying obscure drillers in scrap metal and backpacks stuffed with cash.