Jul 3, 2020

S&P Sees No Imminent Risk to Indonesia Rating From Debt Plan

, Bloomberg News

(Bloomberg) -- The Indonesian government’s plan to sell billions of dollars of bonds to the central bank to finance a widening fiscal deficit poses no immediate threat to the nation’s credit rating, according to S&P Global Ratings.

S&P, which already has a negative outlook on Indonesia’s rating, makes no distinction between the debt issued by the government, be it to the central bank or to commercial investors, in assessing its fiscal impact, according to Kim Eng Tan, a sovereign analyst. Moody’s Investor Service said separately that inflation is well-anchored in Indonesia and the credit outlook would depend on debt duration and other constraints.

“Unless there are material and unforeseen economic or financial disruptions, we do not believe that this plan will affect the credit metrics more than we currently expect,” Tan said.

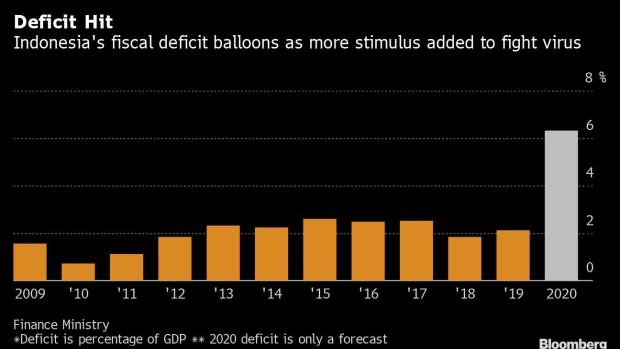

S&P recently downgraded its outlook on Indonesia’s BBB rating, the second-lowest investment grade score, because of the expected fiscal deterioration brought about by Covid-19.

Indonesia’s currency tumbled 2.1% this week on concern the plan to split the cost of funding the budget deficit with the central bank will weaken its independence and trigger rating downgrades. The cost of protecting Indonesia’s five-year dollar bonds, or credit-default swaps, slid 14 basis points this week, the most in a month.

The so-called burden-sharing plan is under “tough discussion” by the government and Bank Indonesia to ensure a prudent plan that maintains both monetary independence and fiscal integrity, a senior Finance Ministry official said Friday.

Read More: Why Bank Indonesia Will Fund $40 Billion of Government’s Budget

Under the deficit financing proposals, Bank Indonesia may buy bonds worth 574.4 trillion rupiah ($40 billion) to fund the government’s pandemic response, according to the Finance Ministry. President Joko Widodo’s administration needs to borrow 1.65 quadrillion rupiah this year to fund a budget deficit of 6.34% of gross domestic product and repay its debts.

Not Large

While some economists have argued the deficit funding may impact inflation and money supply in the long run, S&P’s Tan said the size of the program wasn’t large enough to materially affect monetary operations.

“The impact of inflation, which recently fell below 2%, will depend partly on how much Bank Indonesia offsets the liquidity impact of its bond purchases,” Tan said in an emailed response to questions. “This is no different from the situation that the bank faces in its ordinary course of monetary operations.”

For Moody’s, what will influence its rating decision will be “the duration and other binding constraints under which the measures are extended,” Anushka Shah, a senior analyst in Singapore, said in an email. That “in turn would determine the scope and extent of their usage as a lever to increase fiscal expenditure beyond what is deemed necessary for economic recovery and rehabilitation,” she said.

Fiscal Buffers

Indonesia is rated Baa2 at Moody’s, equivalent to S&P’s rating.

While the stimulus measures announced by Indonesia’s government will have some effect on fiscal and debt metrics, the impact will not be markedly different from the likely deterioration in other regions, Shah said. Southeast Asia’s largest economy entered the crisis with comparatively strong fiscal buffers, providing it some fiscal space to react, she said.

“Like many emerging markets globally, BI’s move towards unconventional quantitative easing represents one way for the government to fund its wider borrowing requirements in the wake of higher coronavirus-related spending and stimulus measures,” Shah said. “For systems like Indonesia where inflation is well-anchored by a generally credible monetary policy framework, such measures will alleviate the impact on debt affordability by limiting interest costs.”

(Updates with performance of credit-default swaps in fifth paragraph.)

©2020 Bloomberg L.P.