Dec 14, 2023

Swedish Real Estate, Mining Stocks Lead Post-Fed Rally in Europe

, Bloomberg News

(Bloomberg) -- European stocks rallied to their highest since early 2022, led by real estate, renewable energy and miners, as conviction grew that the world’s most influential central banks are well on their way to cutting interest rates.

The Stoxx Europe 600 Index closed 0.9% higher, having earlier jumped 1.7% to touch its highest level since January 2022. The early gains were driven by signs that the Federal Reserve was ready to start cutting rates next year. However, sentiment was dampened after European Central Bank President Christine Lagarde said rate cuts had not been discussed “at all” at the bank’s Thursday meeting.

“The ECB is trying to have a balanced tone,” said Mohit Kumar, chief European economist at Jefferies International. “It’s definitely not a shift to the dovish side like the Fed. Rates will need to be kept at these levels for some time.”

The overall positive impulse remains intact, however, given Federal Reserve Chair Jerome Powell’s comments suggesting a historic policy-tightening campaign is over, and aggressive monetary easing is likely to come. Investors are now pricing in six quarter-point cuts in 2024 by the Fed, with the BOE and the ECB also seen easing policy. Bond yields fell worldwide.

Read more: It’s the Left-Behind Stocks Storming Ahead Now, Not Big Tech

Battered real estate stocks such as Fabege AB, Sagax AB, Vonovia SE and SBB posted robust gains, while among miners, Anglo American Plc — Europe’s worst-performing mining stock of 2023 advanced. An index of renewable energy shares also surged, led by Orsted and Vestas Wind Systems A/S.

“This is a Fed recovery trend, and as long as the Fed does not shift direction, this trend is likely to be with us,” said Florian Ielpo, head of macro research at Lombard Odier Asset Management.

Read more: Wall Street Traders Go All-In on Great Monetary Pivot of 2024

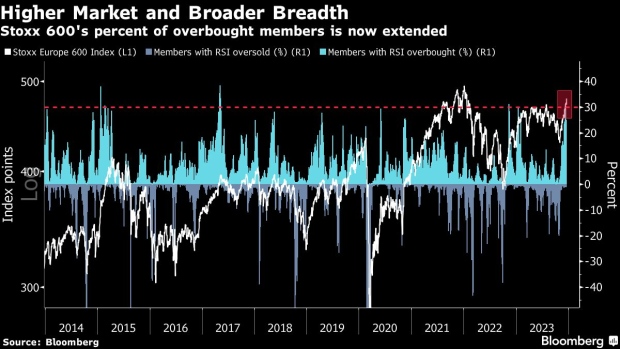

European stocks have rallied about 11% from a low in late-October, taking regional benchmarks, including in France and Germany, to record highs. However, technical indicators now show the Stoxx 600 is at the most overbought level in two years, while the blue-chip Euro Stoxx 50 appears the most overbought since 1999.

The ECB left interest rates unchanged for a second meeting, as expected, while the Bank of England held rates at a 15-year high and said “there is still some way to go” in the fight to control inflation. Norway’s central bank pushed ahead with another hike, defying the global dovish shift.

Traders trimmed their expectations of policy-easing from the ECB, however, and see about 150 basis points of rate reductions next year, down from 165 basis points priced earlier in the day. While Lagarde said policymakers should not lower their guard on inflation, she at least “didn’t spoil the party” said Harry Wolhandler, head of equities at Meeschaert Asset Management in Paris.

Here’s what analysts and strategists are saying post-Fed:

Peter Toogood, chief investment officer at Embark Group

“A few weeks ago the Fed was saying that tightening financial conditions are doing the job for them - what now? It’s hard to square that. I personally don’t think there’s much slack in the US economy, and next year I wouldn’t be surprised to see inflation come back again. The market is too optimistic about future rate cuts but for now its party on till Christmas.”

Marija Veitmane, senior multi-asset strategist at State Street Global Markets

“I think that the sharp rally in risk is likely to continue. It seems that most market participants were not expecting Fed to be that dovish, so there is a lot of catching up going on today.”

Francisco Simon, European head of strategy at Santander AM

“The Fed has fueled positive market reactions by reducing risks on possible rate hikes, with a clearer vision towards cuts and a positive macro scenario, with no risk of recession and inflation on the right track. The lower monetary policy uncertainty will support the valuations of risk assets, which we hope will perform well in this new, very Goldilocks scenario.”

Michael Field, European market strategist at Morningstar

““The market is definitely buying on the rumor today. We haven’t seen anything materialize, and yet it’s got very excited. The problem with this is that it’s kind of easy come, easy go. We saw this over the last few months as well, the same pattern where the market gets very excited and then it slowly tails off again and some of those gains just disappear. Yes, it’s lovely to have this kind of Santa rally. But, at the same time, I think some of the gains we’ve seen today could be quite fickle.”

Fabiana Fedeli, CIO of equities, multi asset and sustainability at M&G Plc

“For me, the biggest data point that you have to look at right now is core inflation. How far is it coming down and what the behaviour of central banks will be, because if inflation doesn’t come down enough and to where it should be, the only reason why central banks would cut rates as aggressively as the market expects is because the economy is really degenerating rapidly, and that is not going to be good for risk assets”

For more on equity markets:

- Peak Rates Is Actually Not Good News for Banks: Taking Stock

- M&A Watch Europe: Vivendi, Marel, Continental, MorphoSys

- A Boots IPO Could Be London Bourse’s Biggest in Years: ECM Watch

- Nasdaq 100 Eyes Record High as Fed Signals Rate Cuts Next Year

- Entain CEO Takes Her Chips Off the Table: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Allegra Catelli, Michael Msika, Sagarika Jaisinghani and Julien Ponthus.

©2023 Bloomberg L.P.