Aug 6, 2019

Thai Baht's Haven Status in Full View as Turmoil Rocks Markets

, Bloomberg News

(Bloomberg) -- The Thai baht is showing its resilience by surviving the turbulence that’s rocked emerging markets so far in August.

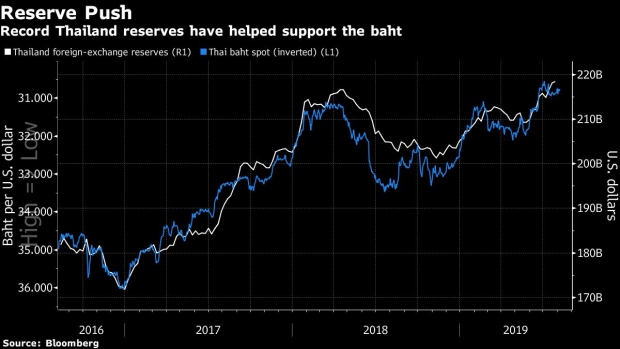

The baht is steady this month, compared with declines of more than 1% in other emerging Asian currencies, strengthening its status as a haven in the region. The nation’s current-account surplus and record reserves are boosting the baht’s allure.

“The baht has become a refuge for investors in the region during times of risk aversion,” said Khoon Goh, head of Asia research at Australia & New Zealand Banking Group Ltd. in Singapore. “Its recent outperformance is a testament to that.”

Global emerging markets have been hit by the triple whammy of the Federal Reserve, Donald Trump and the Chinese yuan. China on Monday let the yuan weaken past 7 against the dollar in a retaliation against the threat of new U.S. tariffs, worrying traders already unnerved by the Fed’s signal that it won’t pursue an extended easing cycle.

Fundamentals

For investors looking for safety, the baht is a strong candidate given Thailand’s fundamentals. Foreign-exchange reserves are at an all-time high of $218.5 billion, and the central bank has forecast a current-account surplus of about 6.4% of gross domestic product in 2019.

Unlike Taiwan and South Korea, which run current-account surpluses as well, Thailand is not in the direct line of fire in terms of the supply-chain impact of the global trade wars, said Sim Moh Siong, currency strategist at Bank of Singapore Ltd.

“We haven’t had significant impact from the worsening trade war like other emerging markets,” said Jitipol Puksamatanan, chief strategist at Krung Thai Bank Pcl in Bangkok. “Our stocks and bonds remain attractive and the Bank of Thailand is unlikely to cut the key rate anytime soon.”

--With assistance from Matt Turner.

To contact the reporters on this story: Lilian Karunungan in Singapore at lkarunungan@bloomberg.net;Suttinee Yuvejwattana in Bangkok at suttinee1@bloomberg.net

To contact the editors responsible for this story: Tomoko Yamazaki at tyamazaki@bloomberg.net, Karl Lester M. Yap, Sunil Jagtiani

©2019 Bloomberg L.P.