Apr 11, 2023

Traders Are Betting Against Airlines at Highest Rate Since Pandemic

, Bloomberg News

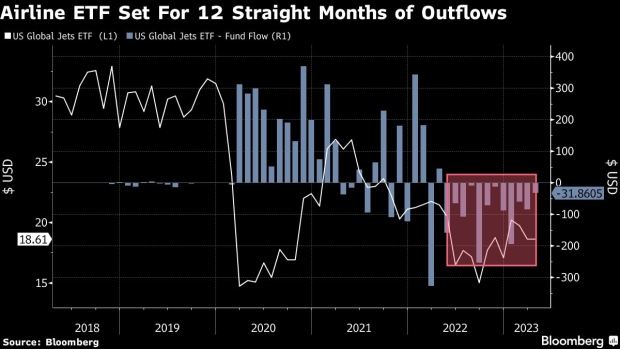

(Bloomberg) -- Investors are betting on a challenging travel season for airlines as sky-high prices and the steady drumbeat of an approaching recession threaten to keep passengers away.

Wagers against the airline industry are now the highest since March 2020 — when outlook for the sector had plunged amid the pandemic — with short interest in the $1.8 billion US Global Jets exchange-traded fund (ticker JETS) currently over 10% of the ETF’s float, according to S3.

“Airlines trade at a low multiple, but are extremely highly leveraged and there are serious risks on the horizon,” said Michael O’Rourke, chief market strategist at JonesTrading.

While the combination of pent-up travel demand and an inflationary environment have fueled the businesses recently, the strategist said, there are now growing expectations that those key tailwinds will start to fade.

“That, in combination with rising recession risk has some investors willing to bet against the group believing there are multiple situational outcomes where airlines can lose,” O’Rourke said.

Concerns about travel demand have been building in recent months, with booking data showing signs of softening. In addition, anxiety is rising about the financial health of the American consumer caught between persistently high inflation and a possible economic slowdown.

As the carriers start reporting first-quarter results later this weeks starting with Delta Air Lines Inc., investors will be watching the outlook for summer travel.

“We expect the focus of first-quarter earnings season to be on second-quarter revenue guidance and commentary on the upcoming peak summer travel season,” BofA analyst Andrew Didora wrote in a note on Tuesday. Didora noted that booking data has slowed since mid-March by about 400 basis points, sparking caution about revenue for the April-to-June period.

Meanwhile, the recent surge in oil prices — after a surprise cut in oil production announced by OPEC+ earlier this month — is also weighing on airline stocks and investor sentiment since jet fuel represents a significant chunk of the companies’ costs.

Shares of US airlines started off the year on a strong note amid hopes for strong growth, but that rally quickly fizzled as the banking crisis early in March deepened recession fears. Since the end of February, the S&P Supercomposite Airlines Index has lost 8.8%, while the broader S&P 500 Index has gained 3.6%.

Still, some investors see the depressed valuations as an opportunity. Strong results from Delta on Thursday and a key inflation reading on Wednesday could turn the tables quickly.

“I like airlines here; I think they are coming off bottoms and look like they want to go higher from here,” said Matthew Tuttle, chief investment officer at Tuttle Capital Management. “Obviously, we have a lot of data coming out this week that could change the landscape, but if the numbers are benign I would be looking to buy the bigger airlines — Delta, United, American.”

©2023 Bloomberg L.P.