Dec 13, 2023

Treasury Yields Plunge as Fed Greenlights Interest-Rate Cuts

, Bloomberg News

(Bloomberg) -- The yield on 10-year US Treasuries fell below 4% for the first time since August, as traders took the Federal Reserve’s signal that it’s done raising interest rates to ramp up bets for more aggressive cuts in 2024.

That came after the Treasury market staged its biggest one-day rally on Wednesday since several regional banks went belly-up in March. On Thursday in Asia, the rate on two-year notes extended declines after plunging as much as 31 basis points in the previous session, and the 10-year yield traded at 3.998%.

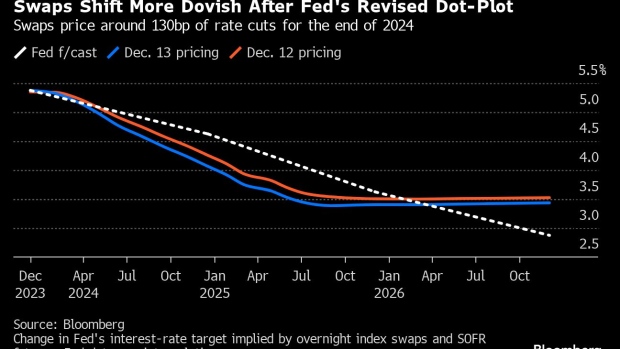

Following their last meeting of the year, Fed policy makers published new quarterly forecasts for the overnight lending rate they control, while leaving their target range for the rate unchanged at 5.25%-5.5%. The median forecast for the end of next year was 4.625%, compared with a median of 5.125% in September. Fed swap rates that anticipate policy changes repriced to levels consistent with more than 140 basis points of easing, up from about 113 basis points before the meeting.

“This is a green light for investors,” Jeffrey Rosenberg, a portfolio manager at BlackRock Inc., said on Bloomberg Television. The Fed “is very happy with what they’ve seen,” and “you can’t really fight this until there is some kind of fundamental data from the economy side that pushes back.”

The bond market — which has been punished over much of the past three years by a surge in consumer inflation and Fed rate increases aimed at squelching it — now is envisioning a course-reversal that will boost the value of debt sold when yields were higher. That has been made possible by inflation ebbing faster than many investors expected, even as the economy continues to show resilience.

Yields extended their declines during the post-meeting news conference by Fed Chair Jerome Powell in which he discussed the deliberations. A Bloomberg gauge of the dollar dropped 0.2% on Thursday.

Read more: Dollar Has Worst Day in a Month as Fed Rate Cuts Dent Appeal

Powell said policy makers discussed the timing of rate cuts at their two-day meeting that ended Wednesday, however he also said inflation remains too high and that further rate increases can’t be ruled out. In September, the median forecast for this year was for an additional quarter-point hike.

Expectations for Fed rate cuts in 2024 have been mounting, and surged on Dec. 1 after the ISM manufacturing report for November was weaker than expected. Swaps priced in a better-than-even chance of either a quarter-point cut in March or a half-point cut in May, and more than 130 basis points of easing by the end of the year. Those levels were surpassed after the new Fed forecasts were published.

Wednesday’s announcements followed the release of producer price data for November that showed less inflation than expected, which led traders to price in slightly more easing in 2024. Earlier in the session, Treasuries also benefited from a rally in gilts and bunds ahead of the Bank of England and European Central Bank meetings Thursday.

Read more: Traders Bet BOE Will Cut Interest Rates Aggressively Next Year

“The end of the year, plus two other major central banks tomorrow — all of that is contributing to the magnitude of the move we’re seeing now,” said Leah Traub, a portfolio manager at Lord Abbett & Co. “I do think the market is getting ahead of itself, but I do think we have to acknowledge there has been a shift in the Fed’s reaction function.”

Treasury yields remain high by recent historical standards, the five-year having traded below 0.20% during 2020 when the Fed’s interest rate was 0% and the central bank was buying Treasury securities to further support the US economy.

--With assistance from Edward Bolingbroke and Tian Chen.

(Update prices in first two paragraphs and 6th paragraph.)

©2023 Bloomberg L.P.