Apr 16, 2021

U.S. Drops Switzerland, Vietnam Currency-Manipulator Labels

, Bloomberg News

(Bloomberg) -- The U.S. refrained from designating any trading partner as a currency manipulator in the Biden administration’s first foreign-exchange policy report, even as Switzerland, Taiwan and Vietnam met thresholds for the label.

The Treasury Department said Friday that those three economies met criteria for the manipulator label, including a large trade surplus with the U.S. But the administration said there was “insufficient evidence” to conclude that the three trading partners showed the intent of “preventing effective balance of payments adjustments or gaining unfair competitive advantage in international trade” to apply the tag.

A Treasury official told reporters that the decision not to designate any nation a manipulator should not be seen as a mixed message. In December, the last report done under President Donald Trump designated Switzerland and Vietnam as manipulators.

The new assessments signal the Biden administration is taking a less confrontational approach to international currency policy after the Trump administration’s labeling of China and other countries as manipulators proved ineffective and spurred concerns of politicization.

The U.S. acknowledged that the unprecedented nature of the coronavirus pandemic’s impact on the global economy led to creative policy responses by governments and central banks. For that reason, the Treasury said it seeks a deeper understanding of Switzerland’s Taiwan’s and Vietnam’s currency actions in order to determine if the interventions were done with the “intent” of gaining an unfair trade advantage, or to cope with the crisis.

Watch List

Ireland and Mexico were added to the Treasury’s watch list, which means they met two of the three criteria for designation. The Treasury kept China, Thailand, India, Japan, South Korea, Germany, Italy, Singapore and Malaysia on the monitoring list.

The Treasury Department said China’s “failure” to be more transparent around activities at state-owned banks warrants close monitoring. Those banks can act in currency markets with official guidance due to close relationships with China’s central bank.

“Treasury is working tirelessly to address efforts by foreign economies to artificially manipulate their currency values that put American workers at an unfair disadvantage,” Treasury Secretary Janet Yellen said in a statement accompanying the report.

The manipulator designation has no specific or immediate consequence, beyond any short-term market impacts. But the law requires the administration to engage with the trading partners to address the perceived exchange-rate imbalance. Penalties, including exclusion from U.S. government contracts, could be applied after a year unless the label were removed.

The Bloomberg dollar index remained lower on the day following the release of the report, with the greenback down around 0.3% versus the Swiss franc. The offshore Chinese yuan maintained a small gain for the day, while one-month non-deliverable forwards on the U.S. dollar against its Taiwanese counterpart edged slightly higher after the news.

During the Trump era, the Treasury abruptly designated China a manipulator in mid-2019 outside its usual release schedule, only to lift the label five months later to win concessions in a trade deal.

Swiss officials have denied the manipulator charge and continued the nation’s purchases of foreign currencies as part of a long-running campaign to fight deflation through negative interest rates and currency intervention.

Earlier this month, the International Monetary Fund gave the Swiss National Bank a green light for its purchases of foreign exchange, while also recommending that officials follow counterparts with a strategy review.

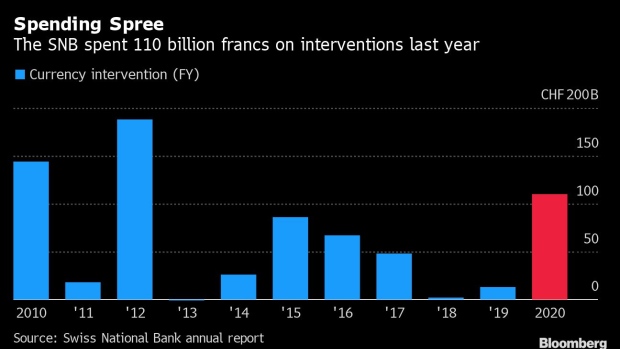

The Swiss National Bank spent 110 billion francs ($120 billion) on foreign-exchange interventions in 2020.

The U.S. moved Taiwan from its watch list to the separate list of those meeting all three criteria for distortionary currency policies. As with Switzerland and Vietnam, Treasury officials said Taiwan met the criteria laid out in a 2015 law by a wide margin, but declined to name the country as a “manipulator” under a related 1988 act.

Taiwan’s central bank has acknowledged intervening in foreign exchange markets to pare gains by Taiwan’s currency against the dollar. Daily efforts to stabilize the Taiwan dollar began in earnest in June 2020 until September. Since then, it appears that the bank has been managing the currency’s appreciation.

The bank’s governor, Yang Chin-long, said in March he believed the U.S. might designate Taiwan a currency manipulator, but he didn’t expect serious negative impact for the local economy, given robust U.S. demand for semiconductors. Semiconductors, he said, were the main factor driving Taiwan’s trade surplus with the U.S.

(Updates with more details and market trading starting in third paragraph.)

©2021 Bloomberg L.P.