Jan 19, 2022

U.S. Leveraged-Loan Price Index Soars to the Highest Since 2007

, Bloomberg News

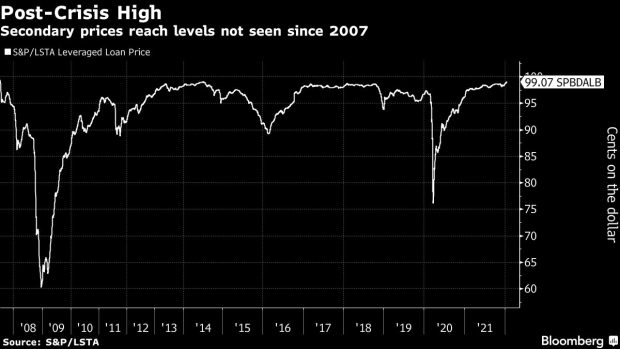

(Bloomberg) -- U.S. leveraged loans continue to hold sway over investors looking for protection against inflation and rising rates, with average prices on the debt reaching the highest level since July 2007.

The S&P/LSTA Leveraged Loan Price Index jumped 0.05% to 99.07 on Wednesday as buyers pile into the risky debt. Demand for the asset class has been robust for some time as its floating-rate benchmarks prove to be a big draw in a potentially volatile increasing-rate environment.

These rate concerns have been a tailwind for funds that invest in U.S. leveraged loans. They pulled in about $1.84 billion of cash for the weekly period ended Jan. 12, according to Refinitiv Lipper data. That intake comes after investors added a whopping $45 billion in 2021. Meanwhile, collateralized loan obligations, the biggest buyers of leveraged loans, ended last year with record issuance of over $183 billion, Bloomberg-compiled data show.

The CLO-driven appetite for loans is poised to remain strong, as well. Analysts at Morgan Stanley project around $160 billion of U.S. CLO issuance this year while JPMorgan Chase & Co. strategists see as much as $135 billion.

Earlier this month, the S&P/LSTA Leveraged Loan Price Index hit what was more than a seven-year high while traders recently lifted bets that the Federal Reserve will implement four quarter-point rate hikes this year.

Although companies have been ramping up sales of leveraged loans in the primary market, a typical December lull left few new issues for investors to buy. That directed them to the secondary market, which helped fuel a jump in loan prices.

Companies looking to the loan market for fresh funds capitalized on low interest rates in 2021 to raise over $862 billion, the highest tally since 2017, according to data compiled by Bloomberg. Mergers and acquisitions in need of financing drove sales, and that’s expected to continue this year.

©2022 Bloomberg L.P.