Aug 3, 2023

US Service Sector Activity Expanded at Slower Pace in July

, Bloomberg News

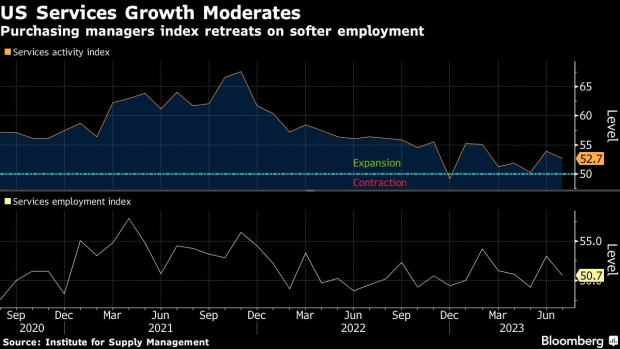

(Bloomberg) -- US service sector activity expanded at a more moderate pace in July, restrained in part by a softening of employment growth.

The Institute for Supply Management’s services index decreased 1.2 points to 52.7 last month, data showed Thursday. Readings above 50 indicate expansion, though the latest figure came in just below expectations.

ISM’s measure of employment at service providers indicated scant hiring during the month. Growth in business activity and new orders slowed somewhat, though those indexes continued to illustrate solid consumer demand for services.

Order backlogs expanded for the first time since February and exports grew at a healthy pace.

Fourteen industries reported growth last month, including construction and accommodation and food services.

“The majority of respondents are cautiously optimistic about business conditions and the overall economy,” Anthony Nieves, chair of the ISM Services Business Survey Committee, said in a statement.

While the manufacturing sector has struggled under the weight of rising interest rates and a shift in consumer spending preferences, the service sector — a much larger part of the economy that includes travel and other experiences — has proved to be much more resilient.

Even though low unemployment and persistent wage growth are underpinning household spending, inflationary pressures have been easing. That said, the Federal Reserve is still a long way from its inflation goal, and that economic resiliency threatens to keep price pressures elevated.

The index for prices paid by service providers for inputs rose to a three-month high, but at 56.8, the measure has generally returned to pre-pandemic levels.

Select ISM Industry Comments

“Pricing in food sectors has come down incrementally, but in very small, almost minute percentages.” - Accommodation & Food Services

“Sales have been steady.” - Construction

“Business remains steady.” - Information

“We are maintaining a cautious approach, although inflation seems to be easing. The overall business environment has stabilized, but tight labor markets are creating ongoing issues.” - Management of Companies & Support Services

“Hiring of employees, temporary workers and consultants continues to be slow as companies remain cautious about increasing fixed and variable expenses during uncertain economic times.” - Professional, Scientific & Technical Services

“Overall economy is good. Supply chain market is stable. Commodity prices are increasing but at a slower rate. Lead times and deliveries are ideal, and inventories are lower than last quarter.” - Retail Trade

“We are still having issues with getting certain materials based on chips, though not nearly as imposing as they were a year ago. Lead times from Europe and in general seem to be improving.” - Transportation & Warehousing

The report did suggest service-sector employers are tapping the brakes on hiring, with the group’s employment gauge falling to 50.7 last month. Some 14.2% of respondents, the smallest share since May 2020, indicated they were increasing payrolls, the report showed.

The government’s jobs report, which is produced by the Bureau of Labor Statistics, will be released on Friday. Economists forecast employers added 200,000 jobs in July while the unemployment rate held at a historically low 3.6%.

--With assistance from Kristy Scheuble.

(Adds ISM industry comments)

©2023 Bloomberg L.P.