Nov 3, 2022

US Services Gauge Falls to Lowest Since May 2020 as Orders Cool

, Bloomberg News

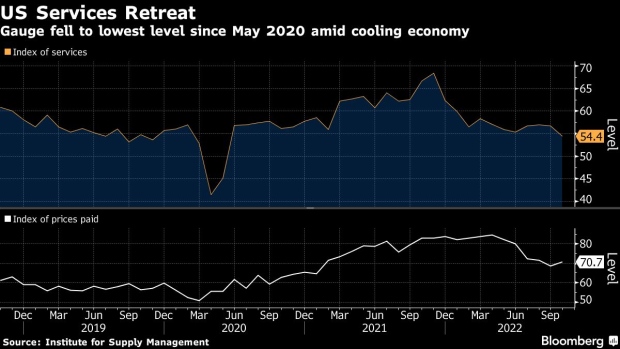

(Bloomberg) -- US service providers expanded in October at the slowest pace since May 2020 as orders growth and business activity moderated, suggesting the broader economy continues to cool.

The Institute for Supply Management’s gauge of services retreated to 54.4 last month from 56.7 in September, according to data released Thursday. The median projection in a Bloomberg survey of economists was 55.3. Readings above 50 signal growth.

The group’s measure of business activity, which parallels the ISM’s factory output gauge, declined to a five-month low, and the new orders index fell to the lowest level since June.

In contrast to the purchasing managers group’s survey of manufacturers, the prices-paid index increased and remains elevated.

The report suggests demand for services is easing amid high inflation, rising interest rates and an uncertain economic outlook. While the Federal Reserve boosted interest rates on Wednesday by another 75 basis points to alleviate price pressures, its campaign to tighten policy runs the risk of sending the economy into a recession.

The ISM’s index of services employment retreated from a six-month high, dropping below the breakeven reading of 50 in October. The figure suggests some industries continue to have trouble hiring, while others are cutting payrolls outright.

“There are still challenges in hiring qualified workers, and due to uncertainty regarding economic conditions, some companies are holding off on backfilling open positions,” Anthony Nieves, chair of the ISM Services Business Survey Committee, said in a statement.

Sixteen services industries reported overall growth last month, led by mining, agriculture, entertainment and recreation, and transportation and warehousing.

Select Industry Comments

“Despite the negative inflation news, higher gas prices and concerns of a recession, our restaurant sales have been resilient during what is typically a seasonal slump...Staffing and supply chain challenges are improving, (and we are) seeing some decline in key commodities.” - Accommodation & Food Services

“Business remains tepid. We have a general concern that sales volumes are trending down as buyers communicate that they’re planning to buy only what they need for immediate sales.” - Agriculture, Forestry, Fishing & Hunting

“Customers are starting to delay projects and/or entering smaller-scale scopes of work. We believe this is a continuation of an uncertain economic environment.” - Construction

“Shortages and delays stabilizing. Labor availability and patient volume continue to be a challenge.” - Health Care

“As we prepare for a recession, our stakeholders, clients and vendors are all tightening their belts and reducing new spend. “ - Professional, Scientific & Technical Services

“It has become more challenging to maintain our level of service, due to increased demand, extended supplier lead times and the hyper-competitive employment market.” - Transportation & Warehousing

“We are experiencing a bullwhip of oversupply on some goods … while still desperately short on other goods. The market is recovering very inconsistently.” - Wholesale Trade

Meantime, delivery times at service providers slowed in a sign that supply chains are not yet back to normal. Services did, however, make a bit more headway on order backlogs as the ISM gauge eased slightly to a five-month low.

Inventory levels continued to shrink in October, though less than in the prior month. A measure of exports contracted by the most since the start of the year, marking a large swing from a month earlier when they surged.

--With assistance from Jordan Yadoo.

(Adds industry comments)

©2022 Bloomberg L.P.