Sep 29, 2022

Warped Oranges Far From Ian’s Core Are Bad Sign for Florida Crop

, Bloomberg News

(Bloomberg) -- Florida orange farmers are just beginning to assess the damage from Hurricane Ian’s devastating winds and rain, but ominous signs are already emerging.

At third-generation citrus grower Peter Spyke’s groves, some 200 miles (322 kilometers) north of where Ian struck the coast, many of the orange stems are twisted and damaged. That means the fruit won’t ripen, he said.

“Fruits are still on the trees, but they don’t have the ability to sustain life from the tree itself,” Marion County-based Spyke said by phone. The full extent of the hurricane’s destruction won’t be revealed for days or weeks, he added.

Spyke’s groves aren’t even near the epicenter of Ian’s wrath. The hardest-hit of the main producing areas lie further south, in Polk, De Soto and Hardee counties, according to Donald Keeney, senior meteorologist at Maxar Technologies Inc. Together, they account for roughly 36% of Florida’s citrus production.

Ian threatens to deal a catastrophic blow to Florida orange growers already reeling from a disease called citrus greening, which damages fruit and eventually kills trees. The storm’s destruction is the latest boost to orange prices that have soared 36% this year on tight global supplies, intensifying consumers’ pain amid rampant food inflation.

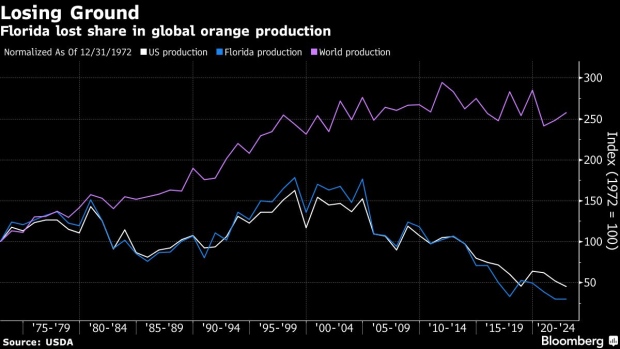

While Ian’s winds have certainly knocked fruit to the ground, tree damage is the biggest concern, according to Jon Davis, chief meteorologist at Everstream Analytics. Once trees are damaged, production can be hurt for years, he said. Florida was already set fall behind California as the largest orange-producing state.

“There is a significant amount of fruit on the ground,” said Raymond Royce, executive director at Highlands County Citrus Growers Association in Sebring, Florida. Though he hasn’t seen significant tree damage, he has yet to do a full assessment because “we are focused on cleaning up our houses now. There’s no power here.”

The US Department of Agriculture is prepared to offer disaster assistance and risk management programs to citrus producers affected by Ian, according to a spokesperson. It could take a week or more to determine the financial impact to citrus growers, according to Christina Morton, communications director at the Florida Fruit and Vegetable Association.

Orange juice futures in New York rose 1.1% to $1.9045 a pound after touching a five-year high on Thursday. Ian’s impact could increase the need for imports to the US, which currently meets 65% of its demand using supplies from other countries. Stockpiles in top producer Brazil are at the lowest since 2017 due to drought.

Still, skyrocketing prices may curb demand from consumers, who were already showing resistance to premium pricing for not-from-concentrate orange juice, said Judy Ganes, president of J Ganes Consulting.

(Updates prices, adds information from Florida association in 8th paragraph)

©2022 Bloomberg L.P.