May 6, 2019

A dip you got paid to buy: How Trump's trade tweets have moved the markets

, Bloomberg News

Trump tweets jeopardize Chinese trade deal

Every drama is unique, but the history of disruptions to U.S. stocks attributable to Donald Trump's trade tweets hints at a pattern.

Since the start of the trade war in March 2018, Trump has fired off dozens of tweets and retweets, and stocks have advanced eight per cent over that span. While the president's musings often immediately spooked the market, equities usually finished up by the end of the day. In virtually every instance, shares were higher a week later.

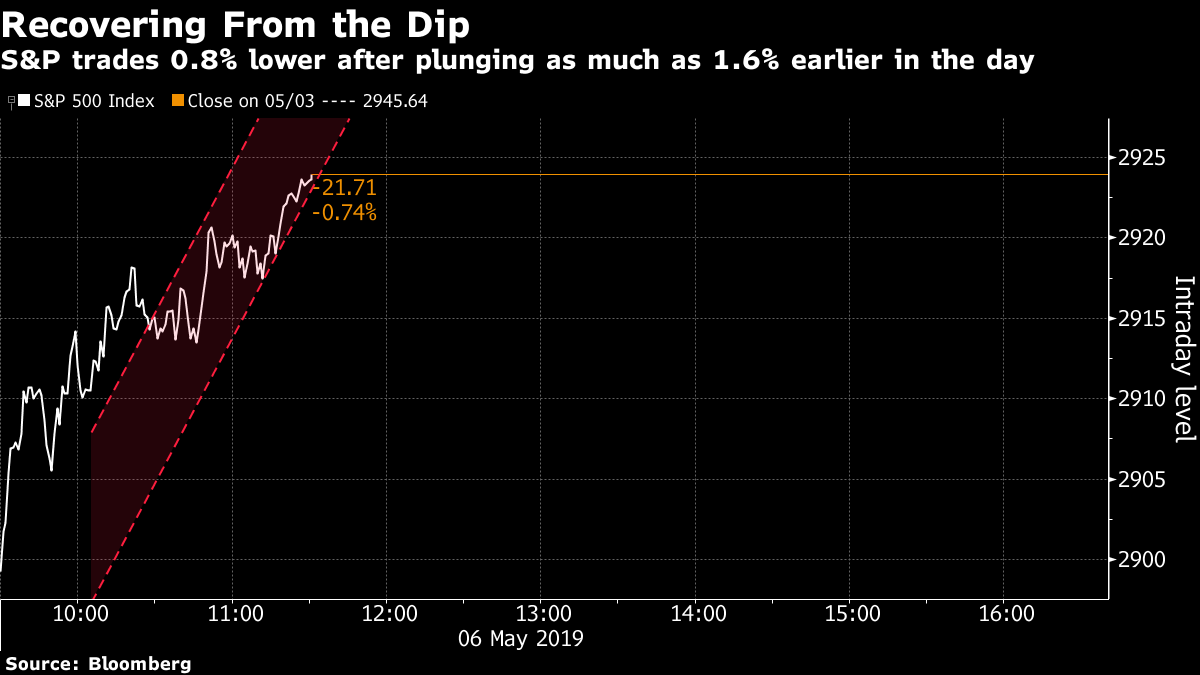

The pattern is being tested anew Monday, after a pair of Trump tweets over the weekend roiled markets from Beijing to New York. The S&P 500 Index sank as much as 1.6 per cent at the open, but had already cut losses in half by mid-morning as a growing chorus of strategists suggested the overnight selloff was just another dip to buy.

“Any pullback is shallow, even as risks of China escalation are probably forthcoming,” Fundstrat Global Advisors LLC strategist Tom Lee said in a note to clients. “We expect funds to buy this dip."

For investors who sent equities to all-time highs just last week, it’s tempting to view the latest pullback as an opportunity to buy. The American economy remains strong, the U.S.Federal Reserve has signalled it’s in no rush to raise rates and corporate earnings have come in better than forecast.

Those same forces have, to varying degrees, been at work throughout the yearlong trade spat and help explain why previous trade-related tweets presented buying opportunities. When Trump said in March 2018 that trade wars are “easy to win,” U.S. stocks tumbled out of the gate only to rebound and close with a gain of 0.5 per cent.

In June, when Trump retracted support for a joint G7 statement while complaining in tweets about comments made by Prime Minister Justin Trudeau about tariffs, American stocks barely budged, adding 0.1 per cent in the next trading session.

Stocks finished the day lower on Sept. 1 after Trump wrote a "no deal" tweet, citing lack of trade agreement with Canada. While stocks traded the next four days in the red, the S&P 500 went on to advance one per cent in the next two weeks to reach a record on Sept. 20.

Since hitting a bottom on Dec. 24, U.S. stocks have been counting on a deal with China to support the rebound from a 20-month low. The S&P 500 Index added 0.9 per cent in late January after Trump tweeted that no deal with Beijing will come until Trump and Xi Jinping reach an agreement on "some of the long standing and more difficult points."