Apr 26, 2024

UBS Weighs Synthetic Risk Transfer Amid Capital Boost Proposals

, Bloomberg News

(Bloomberg) -- UBS Group AG is considering bringing a synthetic credit risk transfer to the market, according to people with knowledge of the matter, amid Swiss reform proposals that could see the bank face higher capital requirements.

The lender is still assessing the type of collateral that could be used in any SRT, the people said, asking not to be identified because the matter is private. UBS may use one of the platforms that it inherited after it took over Credit Suisse last year to put together the transaction, some of the people said.

Talks on the use of an SRT are at an early stage, could take several months, and may not come to fruition, the people said, asking not to be identified as the details are private. Other options are also being considered, they said. A spokesman for UBS declined to comment.

Switzerland’s Federal Council wants systemically-important banks based there to hold significantly more capital against their foreign units to protect against future risks. UBS faces a capital hit that could reach about $20 billion if the reforms come into effect.

The proposal is the “wrong remedy” to the failure of Credit Suisse, UBS Chairman Colm Kelleher said this week, adding the lender is “seriously concerned” about some of the discussions around additional buffers.

Risk Management

SRTs - also known as significant risk transfers - allow banks to buy protection on their loan portfolios in order to release regulatory capital or manage risk. They typically do so by selling notes linked to a pool of loans that also include a credit derivative.

Last year, banks around the world sold $25 billion of SRTs, partially offloading the risk of $300 billion of loans, according to an estimate by Pemberton Asset Management. The instruments can help lenders avoid using less investor friendly measures such as cutting dividends, ending share buybacks or raising new equity to build up their regulatory capital levels. UBS had common equity tier 1 capital of $79 billion at the end of last year.

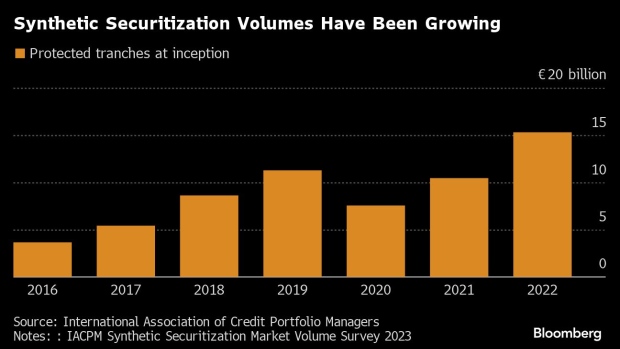

SRTs have been used previously to offload exposure to everything from auto loans to mortgages. Almost all major European banks have used the transactions in recent years, and they are growing in popularity in the US after the Federal Reserve decided in September to broaden the definition of capital relief via credit-linked notes. JPMorgan Chase & Co. and Wells Fargo are among the lenders considering SRTs at present.

Some of the products yield double digit returns, which have drawn interest from buyers including Blackstone Inc. and Oaktree Capital Management Ltd.

©2024 Bloomberg L.P.