Nov 17, 2022

Alibaba Posts Surprise Loss as China Covid Curbs Take a Toll

, Bloomberg News

(Bloomberg) -- Alibaba Group Holding Ltd. reported a surprise loss after quarterly revenue barely grew, as China’s rigid Covid controls continue to depress consumer sentiment.

China’s e-commerce leader reported a net loss of 20.6 billion yuan ($2.9 billion) versus projections for a profit of almost the same amount, after it marked down the value of investments across a portfolio that spans Didi Global Inc. to Indonesia’s GoTo. Its shares fell 3% in early trading in New York.

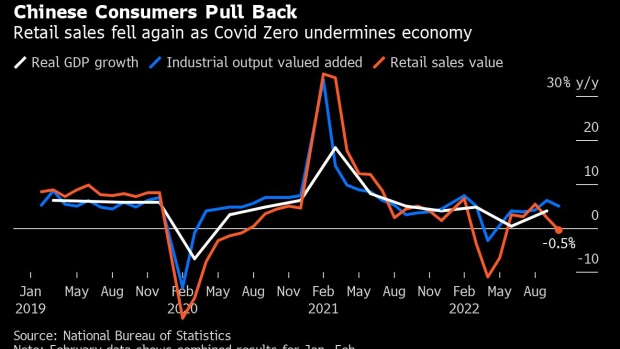

Alibaba is focusing on shoring up its bottom line as Covid policies and antitrust measures imposed during last year’s tech sector crackdown sap growth. This month, the company failed to disclose full sales results for its signature Singles’ Day shopping festival for the first time in 14 years, suggesting a disappointing turnout for its most important annual event. And Chinese retail sales contracted 0.5% in October -- the first decline since May and worse than expectations for slight growth.

On Thursday, executives sounded an optimistic note on an easing of -- or even an eventual end to -- the pandemic restrictions that have snarled logistics, dampened retail activity and otherwise wrought havoc across the world’s No. 2 economy.

“With the introduction of the 20-point pandemic measures from the state authorities, that can be expected to have a positive impact. We certainly do note still some disruption to logistics in certain regions of the country,” Chief Executive Officer Daniel Zhang told analysts on a post-earnings conference call. “But overall we do expect things to continue to improve in a positive direction.”

What Bloomberg Intelligence Says

Alibaba’s stronger-than-expected fiscal 2Q China commerce and cloud profitability raises the likelihood that the company can exceed consensus for 29% growth in adjusted Ebita this fiscal year, we believe, even if revenue increases fall short at both businesses. The company’s international commerce unit might turn profitable in fiscal 2024 if gains persist in Lazada’s monetization rate, which helped shrink losses by two- thirds vs. a year earlier.

-Catherine Lim and Trini Tan, analysts

Click here for the research.

Click here for a live blog of the earnings.

Read more: Jack Ma’s Ant Incurs 63% Profit Fall Amid Regulatory Overhaul

Revenue rose a slightly less-than-expected 3% to 207.2 billion yuan ($29 billion) in the September quarter, after cloud sales -- once the company’s biggest driver -- notched its slowest-ever pace of growth.

Still, investors point to signs Xi Jinping’s administration is retreating from its Covid Zero framework -- easing the logistics tangles that have weighed on Alibaba’s business -- and growing supportive of tech firms. The company also green-lit a significant $15 billion expansion to an existing $25 billion buyback program and extended it to 2025.

Chinese tech shares recovered some of their losses this month, after the Communist Party began pulling back from its pandemic playbook and offered more incentives to President Joe Biden’s administration to work together. Xi’s shift on those fronts, coupled with perceptions of a renewed focus on reviving the world’s No. 2 economy, is spurring speculation that Beijing will begin to unshackle the private sector.

“We believe that Covid will ultimately pass, that our society, our economy, and our lives will eventually return to normal, and that the massive potential of China as the world’s second-largest economy will be further unleashed,” Zhang said.

Once the most valuable company in China, Alibaba has lost about $600 billion of market value since Beijing launched its sweeping crackdown on the private sector nearly two years ago. The government forced its finance affiliate, Ant Group Co., to call off what would have been the world’s largest initial public offering in 2020, then launched reforms that undercut Alibaba’s business model. The fintech giant’s profit plunged 63% in the June quarter.

Cost optimization -- particularly at the relatively younger grocery and overseas businesses -- is likely boosting Alibaba’s margins for the time being. Stripping out the writedowns, Alibaba posted adjusted earnings, which excludes one-time items, ahead of analysts’ projections.

But longer term, it still has to come up with an answer to increasingly effective competition.

While Alibaba said its Singles’ Day sales were in line with last year’s performance, JD.com Inc. is overtaking its larger rival in sales growth and notched another record during the “11.11” shopping festival. JD largely escaped the worst of the 2021 sector crackdown.

Up-and-coming rivals including short video platforms are drawing users away. The number of merchants that participated in Singles’ Day events between Oct. 31 and Nov. 11 on Douyin, the Chinese version of TikTok, increased about 86% from the previous year. The number of buyers on Kuaishou increased by about 40% year on year during the same event, Jefferies estimates.

Facing stagnation at home, Alibaba has revived an outward expansion that slowed in recent years in the face of competition from Amazon.com Inc. and Tencent Holdings Ltd.-backed Sea Ltd.

Subsidiary Lazada Group is preparing to make its maiden foray into Europe, building on its success in Southeast Asia. But the US market remains relatively less hospitable.

Washington added Alibaba to a growing roster of companies facing removal from US stock exchanges due to a longstanding audit dispute between the two countries. Though US audit officials completed their first on-site inspection round of Chinese companies including Alibaba this month, it’s still unclear whether Chinese firms will pass muster.

The company is seeking a primary listing in Hong Kong that would enable it to tap more mainland investors, while also maintaining its listing status on the New York Stock Exchange. On Thursday, Alibaba said that planned conversion of its listing in Hong Kong won’t be completed by the end of 2022 as planned, because of the need to comply with new local regulatory amendments.

--With assistance from Zheping Huang, Sarah Zheng, Lisa Du and Jennifer Ryan.

(Updates with executive’s comments from the fourth paragraph)

©2022 Bloomberg L.P.