Sep 7, 2021

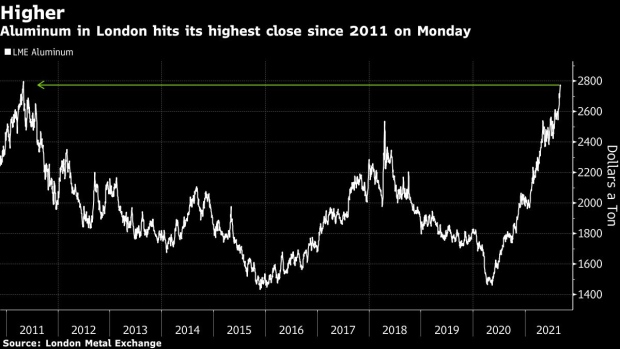

Aluminum Hovers at Decade High as Guinea Coup Fuels Supply Angst

, Bloomberg News

(Bloomberg) -- Aluminum held near the highest in a decade as the coup in Guinea clouded the supply outlook, with the risk of mining disruption threatening to expedite the global market’s descent into deepening deficits.

The leaders of the coup have urged miners in Guinea to maintain output of bauxite -- the key raw material used in aluminum production. Still, one leading supplier, United Co. Rusal International PJSC, warned it may need to evacuate staff if the situation deteriorates. While the market’s worst fears over a sustained outage may not come to pass, analysts and traders remain braced for a short sharp spike in prices throughout the aluminum supply chain.

Already, production curtailments in China are reshaping the outlook for supply. Goldman Sachs Group Inc. and Trafigura Group are among those warning that prices will need to rise sharply to incentivize new output elsewhere as demand surges in the coming years. Stricter environmental controls will raise costs for producers globally, and aluminum prices may need to hit record highs to boost supply significantly, the trading house said on Tuesday.

“This is a story writ large across the commodities complex,” Trafigura’s Chief Economist Saad Rahim said on Bloomberg TV. “It’s really just a clear signal from commodities markets that investment needs to happen and it needs to start happening now.”

Aluminum edged lower to $2,765 a ton as of 10:59 a.m. on the London Metal Exchange, but remained near a decade high of $2,782 a ton struck on Monday. Other metals were mixed, with copper falling 1.1% and zinc adding 0.7%.

©2021 Bloomberg L.P.