Feb 15, 2022

Analyst Price Targets May Be Too Good to Be True as Investors Exit Tech Stocks

, Bloomberg News

(Bloomberg) -- Just when investors are turning bearish on tech stocks, sell-side analysts are sitting tight on their predictions of 50% or more gains for many stocks like Facebook-owner Meta Platforms Inc.

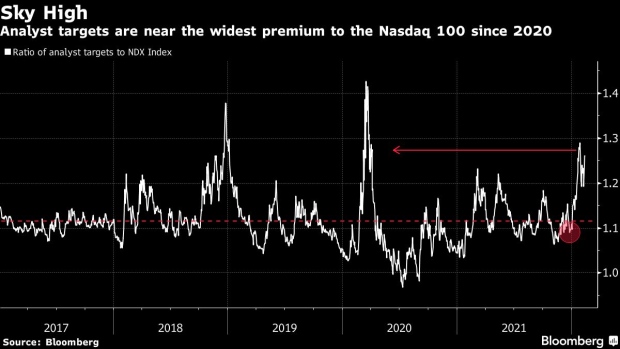

As U.S. equities tumbled in the past two months, brokerage firms in aggregate have hardly budged in their forecasts and the implied gains are getting bigger and bigger. The average stock in the Nasdaq 100 Index will rise 28% in the next year if Wall Street forecasts prove prescient.

Those targets contrast with the opinions of fund managers, who are fast exiting high-growth stocks. Professional investors this month turned the most bearish on technology stocks in almost 16 years, according to a Bank of America Corp. survey of its clients. Pessimism has built amid the Federal Reserve’s plan to raise interest rates at a faster pace than initially thought to tame inflation.

Among the stocks with the biggest potential gains according to analysts are Zoom Video Communications Inc., with 86% upside to the average analyst target, and PayPal Holdings Inc., forecast to rise 59%. As for Meta, while the target has come down by more than $60 since its dismal earnings report this month, the stock still has to rise almost $115, or 53%, to catch up.

The kind of gains predicted by analysts are hardly achievable as interest rates are set to rise, said Jim Dixon, senior equity sales trader at Mirabaud Securities.

“Historically this hasn’t been the ideal scenario to own these stocks,” he said, adding that of the 264 analyst ratings on Amazon.com Inc., Apple Inc., Meta, Google owner Alphabet Inc. and Nvidia Corp., only six are the equivalent of sell.

Analysts, as a whole, tend to be bullish on stocks, but the current optimism is a stretch even by historical measures. At the start of this year, the implied gain for Nasdaq 100 stocks from price targets was 10%, in line with a 5-year average of about 12%.

For Tuesday, at least, the optimism is paying off: the Nasdaq 100 is up 1.6% at 9:44 a.m. in New York as tensions eased between Russia and Ukraine.

Tech Chart of the Day

Top Tech Stories

- Didi Global plans to cut 20% of its employees as the ride-hailing company pushes ahead with plans to transfer its stock-market listing to Hong Kong, people with knowledge of the matter said

- Intel agreed to buy Tower Semiconductor for about $5.4 billion, part of Chief Executive Officer Pat Gelsinger’s push into the outsourced chip-manufacturing business

- Peloton’s sweeping overhaul included the departures of executives running operations, its supply chain and other functions, according to people with knowledge of the matter

- Cathie Wood’s ARK Investment Management LLC took advantage of the record slump in Sea, snapping up more of the gaming firm’s shares after India banned one of its products

- Texas sued Meta Platforms over claims its Facebook and Instagram platforms are still monetizing people’s faces without their consent, as well as holding onto a facial-geometry database compiled over a decade

(Updates shares and gap between target prices throughout.)

©2022 Bloomberg L.P.