Jun 5, 2023

Ares' Direct Loan Fund Raises $8.7 Billion Against Challenging Backdrop

, Bloomberg News

(Bloomberg) -- Ares Management Corp.’s latest European direct lending fund has raised $8.7 billion so far, according to an SEC filing, as the alternative asset manager seeks to build the largest investment vehicle of its kind in the face of a global slowdown in fundraising.

Launched last year, Ares Capital Europe VI reached its first close in recent weeks, according to people familiar with the matter, who weren’t authorized to speak publicly. Hitting that target means that the fund — which focuses exclusively on European investment opportunities — can now start putting capital to work as it continues to raise cash.

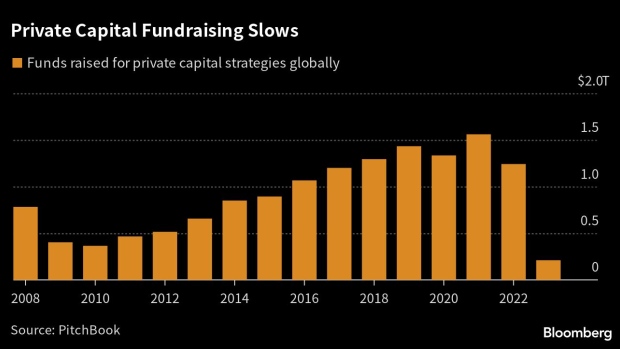

The $1.5 trillion private credit market has been gaining ground over traditional lenders as banks grow more skittish about underwriting deals due to the challenge of selling on debt in leveraged finance markets roiled by inflation, sharp rises in interest rates and geopolitical uncertainty. At the same time, the volatility in public markets has complicated the process of raising capital for direct lending funds over the past year.

Listen: Inside the Private Debt Boom; Korea Bank Stress: Credit Edge

A spokesperson for Ares declined to comment when contacted by Bloomberg News.

The Los Angeles-based firm said in April 2021 it had raised €11 billion ($11.8 billion) for its Ares Capital Europe V Fund, which was the region’s largest direct-lending fund. Mike Arougheti, Ares’ chief executive officer, told analysts in April this year that he expected the new vehicle would surpass that record.

Read more: Ares Prepares to Launch Europe’s Biggest Direct-Lending Fund

Slow Going

Fund managers have noted that firms such as insurers and pension providers are doing more due diligence than previously. Investors are also reviewing their activities in private markets and reducing the number of fund managers they invest in.

In addition, investments in assets such as direct lending funds are not marked to market as often as more mainstream holdings. While that’s part of their appeal for some, that can also limit fund allocations by institutional investors.

In some cases, managers of private markets funds have had to offer investors sizable discounts on management fees to attract money to their funds, the people added. There’s no suggestion that has been the case with the drive by Ares to attract capital.

Investors in previous Ares European direct lending funds include California Public Employees’ Retirement System, Virginia Retirement System and Maine Public Employees Retirement System, according to data compiled by Bloomberg.

©2023 Bloomberg L.P.