Mar 24, 2023

Asia Bank AT1s Also Have Swiss Wipeout Clause, Report Says

, Bloomberg News

(Bloomberg) -- Asia-Pacific banks’ additional Tier 1 bonds contain the same clause used by the Swiss to write down the debt of Credit Suisse Group AG, roiling the global market.

A report by research firm CreditSights said the existing terms and conditions of regional lenders’ AT1 notes “permit the regulators to impose losses on these instruments, similar to what FINMA imposed on the AT1s of Credit Suisse.” Still, Pramod Shenoi, co-head of Asia Pacific research, expects officials in the region only to invoke the clause if a lender lacks capital.

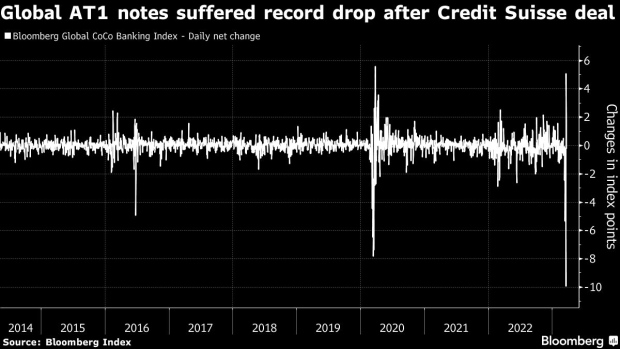

The assessment adds to the debate sparked by the Swiss regulator decision to impose losses on holders of the beleaguered bank’s contingent convertible bonds, known as AT1s, when UBS Group AG pledged to take it over in a government-brokered deal. The move caused an outcry among investors and prompted a global selloff in the securities.

Regarding the basis of their decision, Swiss officials said they used an emergency decree and a provision in the bonds’ issuance prospectus stipulating they’d be entirely written down in the case of a viability event, such as when exceptional government aid was granted. Credit Suisse took emergency liquidity from the central bank.

Although both the Monetary Authority of Singapore and the Hong Kong Monetary Authority have said they’d respect creditor hierarchy, their statements pertained to the case of an institution being wound down, CreditSights said.

Point of Non-Viability “language is typically intentionally left vague as regulators are uncertain regarding the type of situations they may face, but the focus has largely been on capital support and not on liquidity support,” Shenoi wrote. In some instances, “regulators would be able to impose PONV and write off the AT1 bondholders without going through a resolution process, and therefore, without shareholders facing losses.”

(Writes through with additional detail, context)

©2023 Bloomberg L.P.