Oct 31, 2022

Asia Factories Slump as Global Goods Demand Continues to Fade

, Bloomberg News

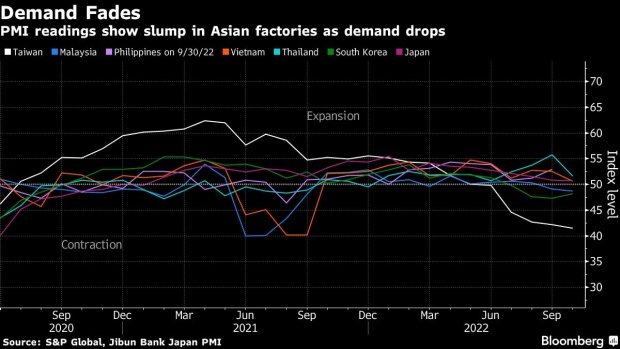

(Bloomberg) -- Asia’s factories slumped in October as global demand for merchandise goods made in the region continues to weaken.

The slowdown in Asia adds to growing evidence that a pronounced deceleration in world trade is underway as soaring inflation and interest rates crimp consumer spending in the US and Europe. South Korea recorded its first decline in exports in two years in October, among the clearest signals yet that the global economy is cooling.

Korea’s trade data came as purchasing managers indexes laid bare the scope of the decline.

Taiwan’s slump was a standout, with the S&P Global manufacturing purchasing managers’ index dropping to 41.5 in October from 42.2 in September to mark its weakest reading since January 2009.

Falling customer orders and demand are accelerating the decline for Taiwan’s factories, which are trimming production in response.

“Weak domestic and international demand conditions were the main drag on the headline figure with the rate of decline in new orders the sharpest since the initial phase of the Covid-19 pandemic in May 2020,” Shreeya Patel, economist at S&P Global Market Intelligence, said in a statement.

Japan’s manufacturing gauge slipped to 50.7 from 50.8. South Korea’s PMI rose to 48.2 from 47.3, still its fourth consecutive month of contraction. The nation also reported its first exports decline in two years on Tuesday, in yet another sign that the global economy is cooling.

A reading above 50 indicates expansion from the previous month, while anything below denotes contraction.

For China, a private gauge of manufacturing pointed to a deteriorating situation in October as Covid control measures continued to weigh on production and demand, although the pace of decline eased. The Caixin Manufacturing Purchasing Managers’ Index came in at 49.2 for the past month, despite a small pickup from September’s 48.1.

Supply, domestic and overseas demand, and employment in the manufacturing sector all contracted in October, according to a statement by Caixin and S&P Global. The findings are largely in line with that of the official PMI, which tracks larger and more state-owned enterprises and also showed a contraction in activities.

The picture was also soft across Southeast Asia. Thailand saw the region’s steepest drop even as its factory activity remained in expansion territory. Its PMI fell to 51.6 from 55.7 as selling prices rose at their fastest rate on record and global demand for goods deteriorated. Indonesia and Vietnam also reported more sluggish expansion in October. Malaysia’s manufacturing activity saw a deeper contraction.

Meanwhile, India posted the region’s best reading of 55.3 in October, climbing from 55.1 the month prior as manufacturers increased employment and inventories in anticipation of better sales.

“The Future Output Index component indicated robust business optimism towards the year-ahead outlook for output,” said Pollyanna De Lima, an economist with S&P Global Market Intelligence.

--With assistance from Lin Zhu.

(Updates with South Korea and India background)

©2022 Bloomberg L.P.