Mar 10, 2023

Asia Sees Limited Contagion Risk From Silicon Valley Bank’s Woes

, Bloomberg News

(Bloomberg) -- Asian bank shares fell in reaction to the crisis at SVB Financial Group, but the region will likely face limited contagion risk due to superior growth prospects, lenders’ diverse customer base, and improving asset quality.

That’s the view of market participants after the drop in region’s lender shares alongside Wall Street peers on concerns that signs of trouble at a key Silicon Valley-based lender may signal broader risks. But the declines in Asia were milder, with the MSCI Asia Pacific Financials Index falling as much as 2.6% compared with a 8.1% tumble in the KBW Bank Index of US lenders.

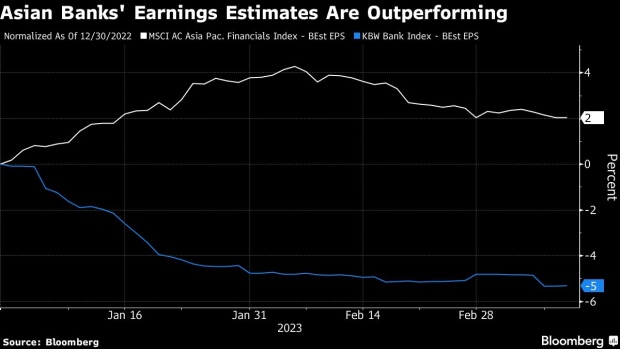

While bank shares in Asia and the US are trading at almost similar accounting book value-based valuations, the former is expected to boost earnings by 29% over the next 12 months compared with little change for the latter, according to data compiled by Bloomberg. Asian lenders have also seen upgrades to profit estimates this year versus downgrades in the US.

Details of the bank share declines suggest that SVB’s troubles weren’t the largest market-moving factor for the the MSCI Asia Pacific Financials Index. The biggest drags as well as losers in the sector were Japanese lenders such as Mitsubishi UFJ Financial Group Inc., which slumped more due to the central bank’s decision to keep its yield-curve control program unchanged at Governor Haruhiko Kuroda’s final meeting.

Here’s a selection of comments on what SVB’s crisis means for the region:

Jonathan Garner, a strategist at Morgan Stanley

“It is obviously negative for banks in the sense that you have opened the door now to sort of credit quality debate.”

Concerns for Asia are relatively mild though, he added, where growth is re-accelerating and asset quality concerns aren’t as prevalent as last year.

Nitin Chanduka, a strategist at Bloomberg Intelligence

“Large banks have well-diversified funding sources unlike SVB whose customers were mainly venture-capital firms and are treading through a tough macro environment.”

The “contagion impact looks limited for Asian banks.”

Ilya Spivak, head of global macro at tastylive, a financial network

“SVB is not directly going to have an impact on Asia, but it’s tremendously important in that it is showing that the pain is starting to move closer from smaller, risky parts of the market such as crypto to more established traditional finance.

Still, it is “compounding what’s going on in Asia markets today” as the financials-heavy markets such as Hong Kong and Australia are among the worst performers.

Kerry Goh, chief investment officer at Kamet Capital Partners Pte.

“In this part of the world, I would be the most worried about the new banks in Indonesia that are lending to high-valued startups in the fintech space and are not well funded.”

“It’s not a like-for-like comparison but this appears to be the part most at risk of contagion.”

Jung Junsup, an analyst at NH Investment & Securities Co.

The rout highlights possible systemic risks in the US and could hurt sentiment among local investors but it would be going “too far” to question the health of Korean banks

Trinh Nguyen, a senior economist at Natixis SA in Hong Kong

“Emerging Asian assets are not only vulnerable from a more risk-off environment due to more hesitant portfolio flows, but also exposed to their own fallout of higher rates” at home.

--With assistance from Youkyung Lee and Karl Lester M. Yap.

©2023 Bloomberg L.P.