Aug 5, 2019

U.S. stocks plunge most this year as trade tension escalates

, Bloomberg News

Market Expects U.S. Retaliation, Escalation as Yuan Weakens: Chandler

Financial markets buckled after China escalated the trade war with the U.S., sending American stocks to the biggest drop this year and sparking a rally in global bonds. Gold surged with the yen.

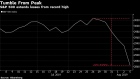

More than US$700 billion were wiped from the value of U.S. equities on Monday, with the S&P 500 Index plunging three per cent and all but 11 companies in the gauge trading lower. Losses in the Dow Jones Industrial Average surpassed 700 points as Apple and IBM slid at least four per cent. The Cboe Volatility Index surged about 40 per cent. The 10-year Treasury yield dropped to the lowest since before President Donald Trump’s election. China’s yuan sank beyond 7 per dollar, a move that suggests the level is no longer a line in the sand for policy makers in Beijing.

Investors are starting to grasp the potential for a protracted conflict between the world’s two largest economies, with a Treasury-market recession indicator hitting the highest alert since 2007. As demand for haven assets spiked, gold made a run toward US$1,500 an ounce and the Japanese yen extended its rally. Major cryptocurrencies, increasingly seen as a refuge during distressed times, climbed as Bitcoin approached US$12,000. Fear gauges for the corporate bond market rose the most since March as traders rushed to hedge their positions.

“The trade war is now intensifying and it’s possible that a currency war will start as well,” said Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. “Neither is good for the global economy and both will hurt equity markets.”

People’s Bank of China Governor Yi Gang said the nation won’t use exchange rates as a tool in the escalating trade dispute. Yet for President Trump, the latest decline in the yuan is “called ‘currency manipulation”’. The American leader also indicated he’d like the Federal Reserve to act to counter the Chinese action. Swaps show bets the central bank will ease by 100 basis points by December 2020, a quarter point more than what was priced in after last week’s cut.

The trade war has been a consistent catalyst for market volatility and hopes of a resolution are now being sent even further out in the horizon, according to Mike Loewengart, vice president of investment strategy at E*Trade Financial Corp. While that could continue to challenge portfolios, investors should not make the mistake of trying to time the markets amid the sell-off, he said.

“This too shall eventually pass, and bouts of volatility in recent months have shown this can happen quickly,” said Loewengart.

These are some key events to watch out for this week:

- Earnings from financial giants include: UniCredit, AIG, ABN Amro Bank, Standard Bank, Japan Post Bank.

- Five Asian central banks have rate decisions including India, Australia and New Zealand.

- A string of Fed policy makers speak this week, including St. Louis chief James Bullard on Tuesday and Chicago’s Charles Evans a day later. All are Federal Open Market Committee voters.

Here are the main moves in markets (all sizes and scopes are on a closing basis):

Stocks

- The S&P 500 declined three per cent to 2,844.74.

- The Stoxx Europe 600 Index decreased 2.3 per cent.

- The MSCI Asia Pacific Index dipped 2.3 per cent

- The MSCI Emerging Market Index slid 3.1 per cent

Currencies

- The Bloomberg Dollar Spot Index decreased 0.1 per cent.

- The euro advanced 0.8 per cent to US$1.1196.

- The Japanese yen increased 0.5 per cent to 106.05 per dollar.

Bonds

- The yield on 10-year Treasuries sank 13 basis points to 1.7142 per cent.

- Germany’s 10-year yield decreased two basis points to -0.52 per cent.

- Britain’s 10-year yield dipped four basis points to 0.512 per cent.

Commodities

- The Bloomberg Commodity Index decreased 0.6 per cent.

- West Texas Intermediate crude slid to US$54.69 a barrel.

- Gold increased to US$1,476.50 an ounce.

--With assistance from Tracy Alloway, Andreea Papuc, Samuel Potter, Laura Curtis, Todd White, Olivia Rinaldi, Nancy Moran, Lu Wang and Sophie Caronello.