Nov 27, 2019

Asia Stocks to Climb as U.S. Notches Up Fresh High: Markets Wrap

, Bloomberg News

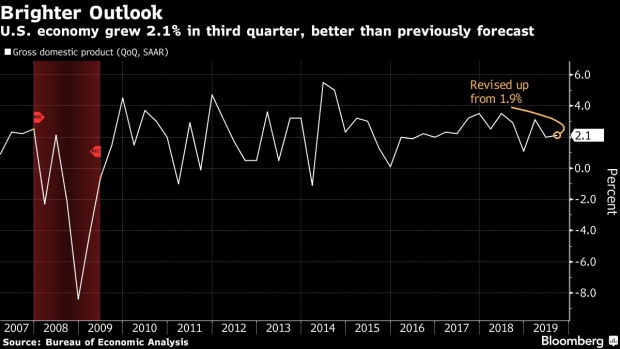

(Bloomberg) -- Stocks in Asia looked set to climb as data confirmed the U.S. economy was a little healthier than originally thought, helping to lift American equities, the dollar and Treasury yields.

Futures rose in Tokyo, Hong Kong and Sydney. The S&P 500 advanced 0.4% and the yield on 10-year Treasuries reversed declines from earlier in the week. Data on U.S. gross domestic product and claims for unemployment beat analysts’ expectations.

With volumes light ahead of the Thanksgiving break and little in the way of trade news, investors latched on the latest economic data. A global benchmark of developing and emerging-market equities remains just below its all-time record, on course for a third month of gains.

“Investors are really pricing in some positives here,” Tracie McMillion, head of global asset allocation strategy at Wells Fargo Investment Institute, told Bloomberg TV. “A positive on a phase-one trade deal, a positive in terms of global central banks continuing their loose monetary policy and a positive in terms of consumers continuing to support economic growth.”

Elsewhere, a drop in Latin American currencies turned into a rout Wednesday as Chile’s peso, Brazil’s real and Colombia’s peso all hit record lows.

Here are some key events coming up this week:

- The U.S. celebrates Thanksgiving on Thursday, when equity and bond markets will be shut.

- Euro area inflation for October is due Friday.

- The Bank of Korea sets policy on Friday.

These are the main moves in markets:

Stocks

- The S&P 500 rose 0.4% on Wednesday.

- Futures on Japan’s Nikkei 225 advanced 0.5%.

- Hang Seng Index futures earlier added 0.2%.

- Futures on Australia’s S&P/ASX 200 Index climbed 0.3%.

Currencies

- The yen was at 109.55 per dollar after slipping 0.5%.

- The offshore yuan held at 7.0147 per dollar.

- The Bloomberg Dollar Spot Index climbed 0.2%.

- The pound added 0.3% to $1.2902.

Bonds

- The yield on 10-year Treasuries rose about three basis points to 1.77%.

Commodities

- West Texas Intermediate crude slid 0.5% to $58.11 a barrel.

- Gold dropped 0.5% to $1,454.59 an ounce.

--With assistance from Romaine Bostick, Scarlet Fu and Sophie Caronello.

To contact the reporter on this story: Adam Haigh in Sydney at ahaigh1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Andreea Papuc

©2019 Bloomberg L.P.