May 20, 2019

Asia Stocks to Drop on Tech Sell-Off; Dollar Falls: Markets Wrap

, Bloomberg News

(Bloomberg) -- Asian stocks are set to decline Tuesday after Washington’s moves against Huawei Technologies Co. sank U.S. technology shares and stoked trade jitters. The dollar slipped.

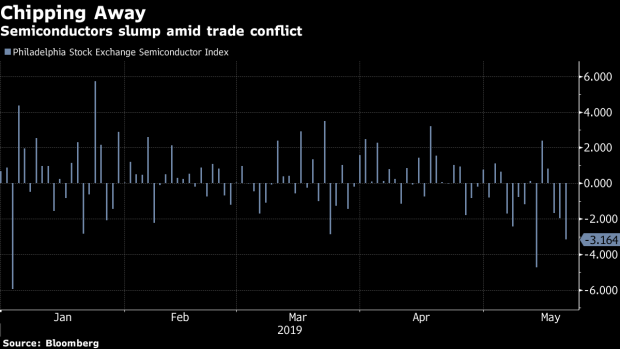

Futures pointed to losses across the region. Companies crucial to the global supply chain will be closely watched after the White House blacklisted the Chinese telecom giant. The S&P 500 Index dropped for the second straight session, with semiconductor stocks among the biggest laggards, and the tech-heavy Nasdaq 100 Index saw its biggest decline in a week. Ten-year Treasury yields rose before a slew of U.S. data this week as well as Federal Reserve policy-meeting minutes on Wednesday.

Markets remain on edge as the trade war develops, with the impact of President Donald Trump’s threats to choke Huawei’s supply chain hitting some of the biggest component-makers. Trump said in an interview he was “very happy” with the trade war and that China wouldn’t become the world’s top superpower under his watch. In response, China could retaliate as Chinese companies’ “legitimate rights and interests are being undermined,” Zhang Ming, the nation’s ambassador to the European Union said.

Elsewhere, software and semiconductor shares also helped pull European stocks lower. Crude fluctuated before ending higher.

Here are some notable events coming up:

- On Tuesday, Bank of England Governor Mark Carney testifies to Parliament about the May inflation report on Tuesday, and Reserve Bank of Australia Governor Philip Lowe speaks in Brisbane.

- The Fed minutes of its FOMC April 30-May 1 policy meeting will be released Wednesday.

- Counting of votes from the Indian general elections takes place Thursday as Prime Minister Narendra Modi attempts to secure a second term.

- ECB President Mario Draghi speaks in Frankfurt on Wednesday.

- The European Parliament holds continent-wide elections May 23-26.

- On Thursday, the ECB publishes its account of the April monetary policy decision.

And these are the main moves in markets:

Stocks

- Nikkei 225 futures fell 0.6% in Singapore.

- Australia’s S&P/ASX 200 Index futures fell 0.6%.

- FTSE China A50 futures dropped 0.8%.

- Hong Kong’s Hang Seng Index futures lost 0.6%.

- The S&P 500 Index fell 0.7%. The Nasdaq 100 dropped 1.7%.

- The Stoxx Europe 600 Index fell 1.1%, its biggest drop in a week.

Currencies

- The yen was steady at 110.08 per dollar.

- The yuan was stable at 6.9407 per dollar.

- Bloomberg Dollar Spot Index lost 0.1%, the biggest drop in over a week.

- The euro held at $1.1168.

Bonds

- The yield on 10-year Treasuries rose two basis points to 2.41%.

Commodities

- West Texas Intermediate crude gained 0.7% to $63.18 a barrel, the highest in almost three weeks.

- Gold was little changed at $1,279 an ounce.

--With assistance from Vildana Hajric.

To contact the reporters on this story: Andreea Papuc in Sydney at apapuc1@bloomberg.net;Sarah Ponczek in New York at sponczek2@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Cormac Mullen

©2019 Bloomberg L.P.