Nov 11, 2019

Asian Stocks Look Set for Gains; Dollar Slips: Markets Wrap

, Bloomberg News

(Bloomberg) -- Stocks in Asia looked set to claw back some of Monday’s losses as investors awaited further developments on a trade deal and kept an eye on the volatile situation in Hong Kong. The dollar fell for the first time in six days.

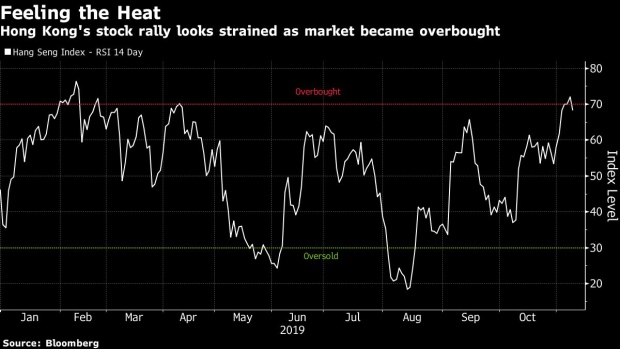

Futures pointed higher in Tokyo, Sydney and Hong Kong, where shares dropped as much as 3% Monday to lead a slide in regional markets on continued unrest in the city. In the U.S., the S&P 500 Index dropped for the first time in four sessions on below average volume. Treasuries were closed for the Veterans’ Day holiday. The pound rallied as Prime Minister Boris Johnson’s efforts to leave the European Union got a boost from the Brexit Party.

Investors are on the lookout for any headlines that could point to a first-phase trade deal between the U.S. and China after mixed messages from the White House and delayed meetings have heightened concerns that negotiations are stumbling. In Asia, violent clashes in Hong Kong where police shot a protester are keeping investors on edge.

“I think markets have been skittish waiting for any concrete information about the trade talks,” said Matt Forester, chief investment officer at BNY Mellon’s Lockwood Advisors. “We will need more concrete information about the structure and timing of any kind of final trade arrangement, but in the meantime we are operating on scraps of information.”

Elsewhere, emerging market shares fell the most in more than two months. Crude oil edged lower.

Here are some key events coming up this week:

- Earnings include Tencent, Nissan Motor, Japan Post Bank and Mitsubishi UFJ.

- New Zealand’s policy decision is due Wednesday, with market pricing tilting in favor of an interest-rate cut.

- Fed Chairman Jerome Powell addresses the Joint Economic Committee of Congress, in Washington Wednesday. Minneapolis Fed President Neel Kashkari speaks in La Crosse, Wisconsin.

- Thursday brings China retail sales and industrial production data.

- U.S. retail sales on Friday are forecast to rebound in October after unexpectedly falling the prior month.

These are the main moves in markets:

Stocks

- Nikkei 225 futures rose 0.5%.

- Australia’s S&P/ASX 200 Index futures added 0.1%.

- Hong Kong’s Hang Seng Index futures climbed 0.7%.

- The S&P 500 Index fell 0.2%.

- The MSCI Emerging Market Index fell 1.1%, the most since Aug. 26.

Currencies

- The yen increased 0.2% to 109.05 per dollar.

- The offshore yuan dropped 0.3% to 7.0065 per dollar.

- The Bloomberg Dollar Spot Index declined 0.1%.

- The euro advanced 0.1% to $1.1032.

- The British pound jumped 0.6% to $1.2851.

Bonds

- Australian bond futures ticked higher.

Commodities

- West Texas Intermediate crude fell 0.7% at $56.87 a barrel.

- Gold fell 0.3% to $1,455.39 an ounce.

To contact the reporter on this story: Andreea Papuc in Sydney at apapuc1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Cormac Mullen

©2019 Bloomberg L.P.