Jan 30, 2019

AT&T sales miss estimates as it sheds more pay-TV customers

, Bloomberg News

AT&T Inc. (T.N) reported fourth-quarter sales that fell short of analysts’ estimates, as the continued loss of pay-TV customers complicates the phone giant’s efforts to become a media powerhouse.

-Sales rose to US$47.99 billion, just below the US$48.5 billion average of analysts’ estimates. The company lost 462,000 pay-TV subscribers, compared with the loss of 191,232 seen by analysts.

Key Insights

-The results follow weak sales figures from rival Verizon Communications Inc. on Tuesday, raising concern about a broader slump for carriers.

-With the purchase of Time Warner for US$85 billion last year, AT&T is gambling that entertainment programming, delivered to home TV sets and to mobile phones, can spark its sluggish revenue growth. The quarterly sales figure failed to top estimates despite the addition of Time Warner.

-The pay-TV division, led by DirecTV, is continuing to lose customers to fast-growing online businesses, like Netflix. Using content from Time Warner, AT&T is developing online businesses of its own, like WatchTV, but those will take time to catch on.

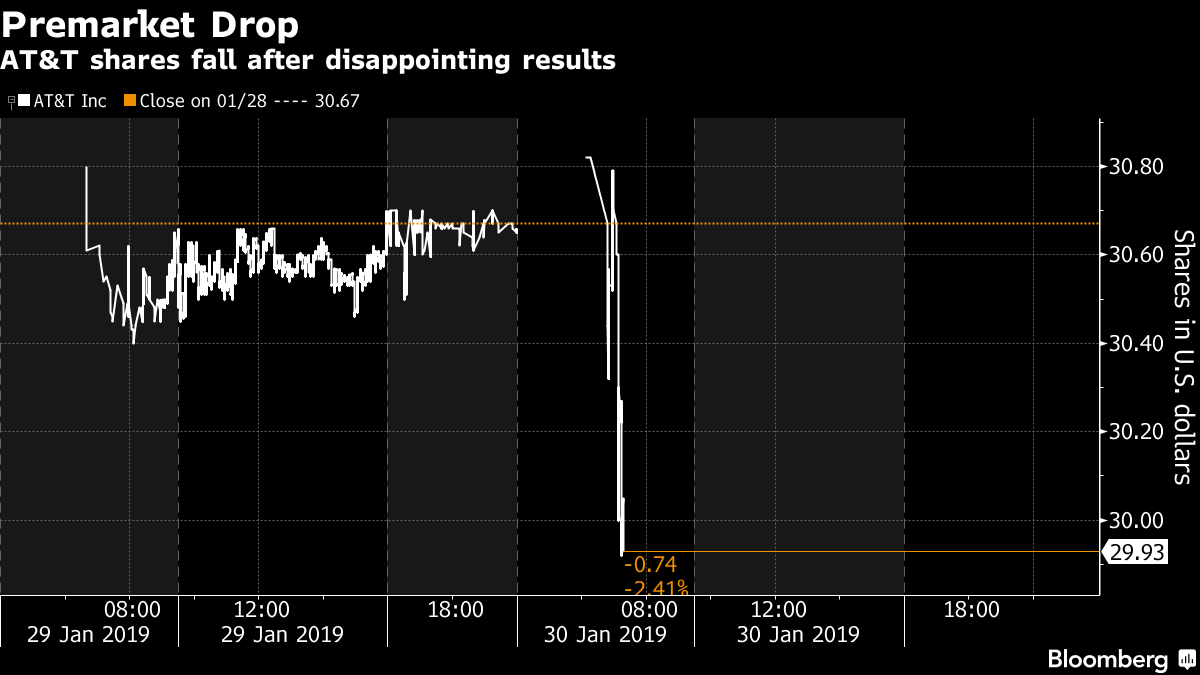

Market Reaction

-AT&T shares fell as much as 2.3 per cent to US$30 in early trading Wednesday. The stock lost 27 per cent last year, lagging behind the 6 per cent gain of Verizon, its biggest competitor.