Feb 6, 2023

Australia’s Venture Capital Deals Slide 30% From Record Year

, Bloomberg News

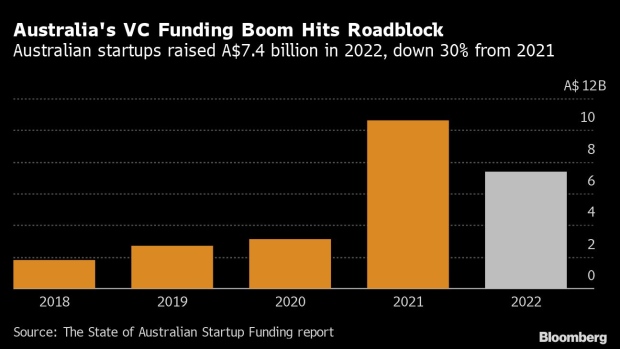

(Bloomberg) -- Venture-capital investments in Australia plunged by about a third in 2022, following the lead of listed global technology companies and venture markets.

Australian startups raised A$7.4 billion ($5.1 billion) across 712 deals in 2022, down from A$10.6 billion across 731 deals in 2021, according to the annual State of Australian Startup Funding report by Cut Through Venture and Folklore Ventures. The research was sponsored by JPMorgan Chase & Co., Silicon Valley Bank, Deloitte, Google Cloud and Sling & Stone.

Payments platform Airwallex raised $100 million in an extension of a Series E funding round in October, while keeping its previous valuation of $5.5 billion.

Six Australian startups hit the unicorn status in 2022, including social media startup Linktree, the report showed. But current market conditions indicate that some of the country’s startups are now at risk of falling below the $1 billion valuation mark, according to the report.

Fintech startups drew the most amount of capital from investors at A$1.3 billion, followed by enterprise software companies, which attracted A$1.2 billion.

(Updates with a chart breaking down venture investments)

©2023 Bloomberg L.P.